Authors

Summary

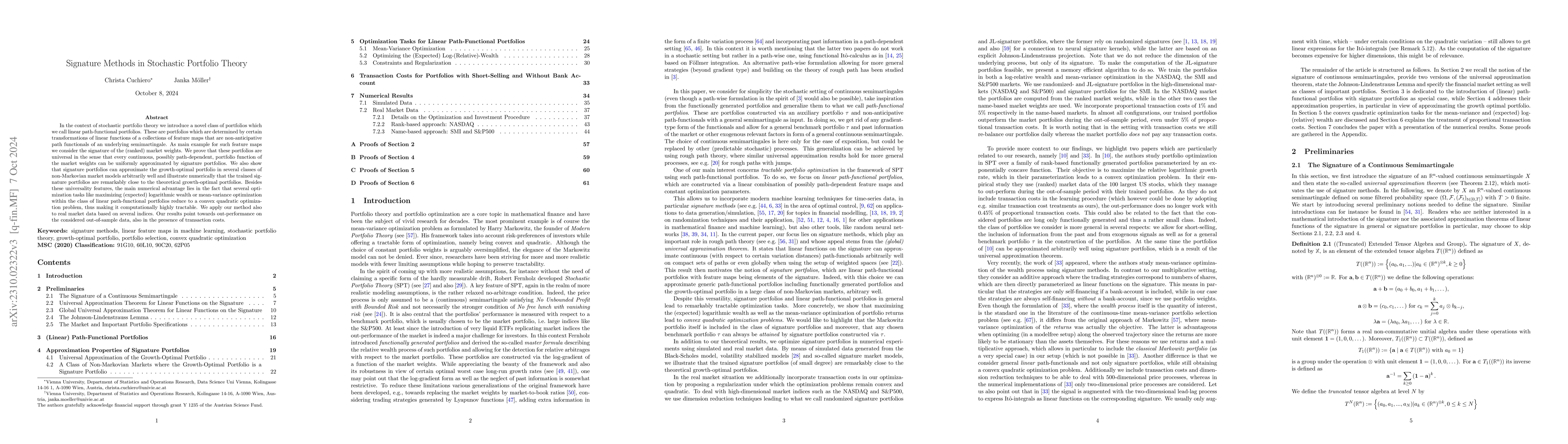

In the context of stochastic portfolio theory we introduce a novel class of portfolios which we call linear path-functional portfolios. These are portfolios which are determined by certain transformations of linear functions of a collections of feature maps that are non-anticipative path functionals of an underlying semimartingale. As main example for such feature maps we consider the signature of the (ranked) market weights. We prove that these portfolios are universal in the sense that every continuous, possibly path-dependent, portfolio function of the market weights can be uniformly approximated by signature portfolios. We also show that signature portfolios can approximate the growth-optimal portfolio in several classes of non-Markovian market models arbitrarily well and illustrate numerically that the trained signature portfolios are remarkably close to the theoretical growth-optimal portfolios. Besides these universality features, the main numerical advantage lies in the fact that several optimization tasks like maximizing (expected) logarithmic wealth or mean-variance optimization within the class of linear path-functional portfolios reduce to a convex quadratic optimization problem, thus making it computationally highly tractable. We apply our method also to real market data based on several indices. Our results point towards out-performance on the considered out-of-sample data, also in the presence of transaction costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRandomized Signature Methods in Optimal Portfolio Selection

Josef Teichmann, Erdinc Akyildirim, Matteo Gambara et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)