Summary

We consider a financial market model with a single risky asset whose price process evolves according to a general jump-diffusion with locally bounded coefficients and where market participants have only access to a partial information flow. For any utility function, we prove that the partial information financial market is locally viable, in the sense that the optimal portfolio problem has a solution up to a stopping time, if and only if the (normalised) marginal utility of the terminal wealth generates a partial information equivalent martingale measure (PIEMM). This equivalence result is proved in a constructive way by relying on maximum principles for stochastic control problems under partial information. We then characterize a global notion of market viability in terms of partial information local martingale deflators (PILMDs). We illustrate our results by means of a simple example.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

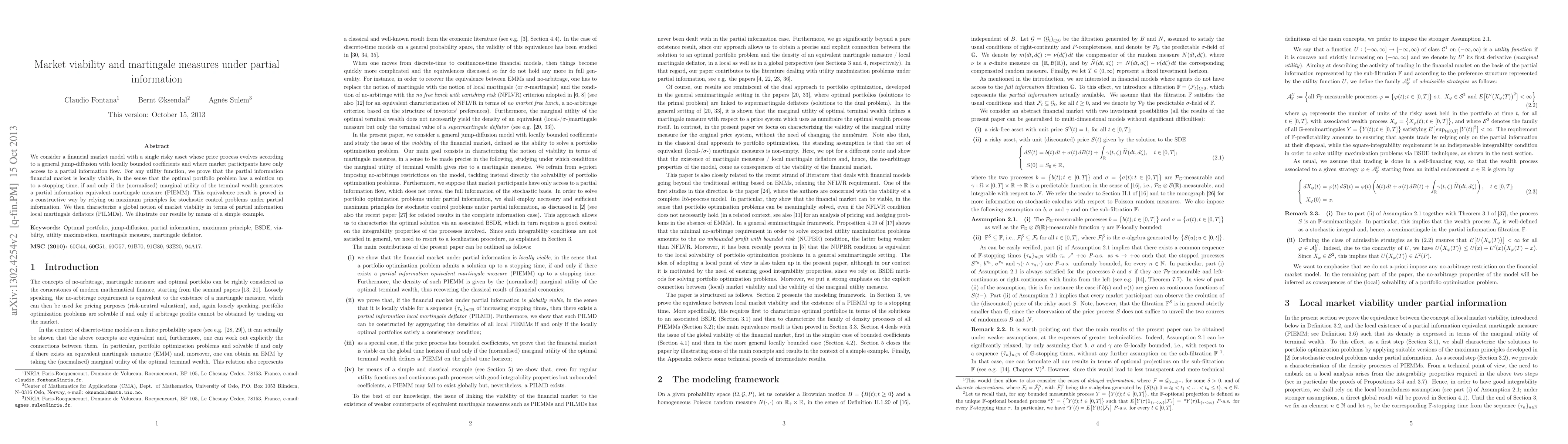

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)