Summary

In this paper, we study the martingale property for a Scott correlated stochastic volatility model, when the correlation coefficient between the Brownian motion driving the volatility and the one driving the asset price process is arbitrary. For this study we verify the martingale property by using the necessary and sufficient conditions given by Bernard \emph{et al.} \cite{Bernard}. Our main results are to prove that the price process is a true and uniformly integrable martingale if and only if $\rho \in [-1,0]$ for two transformations of Brownian motion describing the dynamics of the underling asset.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

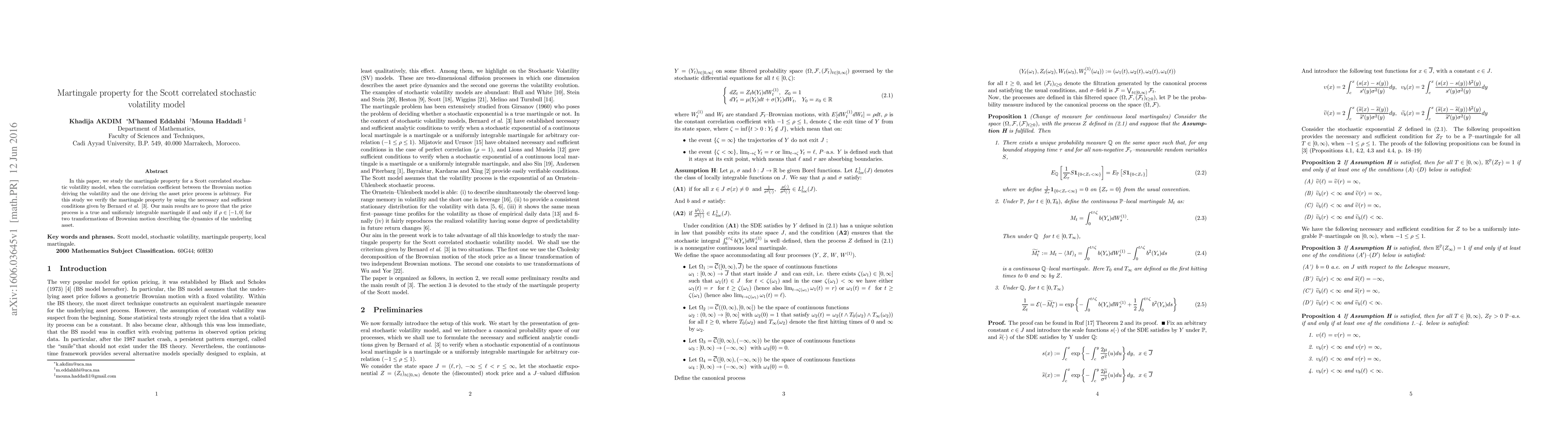

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMartingale property and moment explosions in signature volatility models

Eduardo Abi Jaber, Paul Gassiat, Dimitri Sotnikov

On the entropy minimal martingale measure in the exponential Ornstein-Uhlenbeck stochastic volatility model

Yuri Kabanov, Mikhail A. Sonin

No citations found for this paper.

Comments (0)