Summary

Lions and Musiela (2007) give sufficient conditions to verify when a stochastic exponential of a continuous local martingale is a martingale or a uniformly integrable martingale. Blei and Engelbert (2009) and Mijatovi\'c and Urusov (2012c) give necessary and sufficient conditions in the case of perfect correlation (\rho=1). For financial applications, such as checking the martingale property of the stock price process in correlated stochastic volatility models, we extend their work to the arbitrary correlation case (-1<=\rho<=1). We give a complete classification of the convergence properties of integral functionals of time-homogeneous diffusions and generalize results in Mijatovi\'c and Urusov (2012b) (2012c) with alternate proofs avoiding the use of separating times (concept introduced by Cherny and Urusov (2004) and extensively used in the proofs of Mijatovi\'c and Urusov (2012c)).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

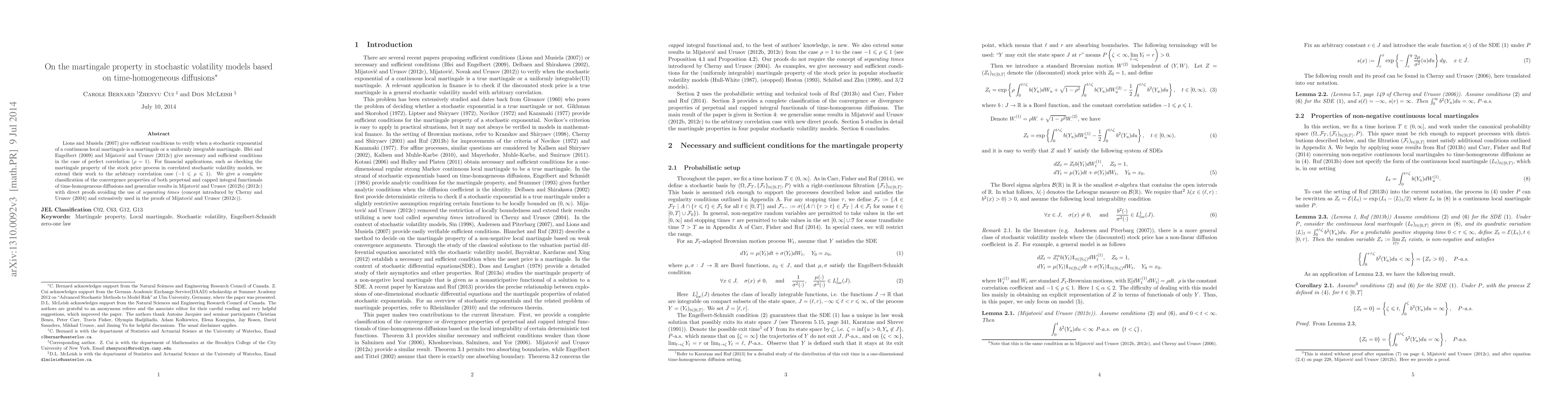

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMartingale property and moment explosions in signature volatility models

Eduardo Abi Jaber, Paul Gassiat, Dimitri Sotnikov

| Title | Authors | Year | Actions |

|---|

Comments (0)