Authors

Summary

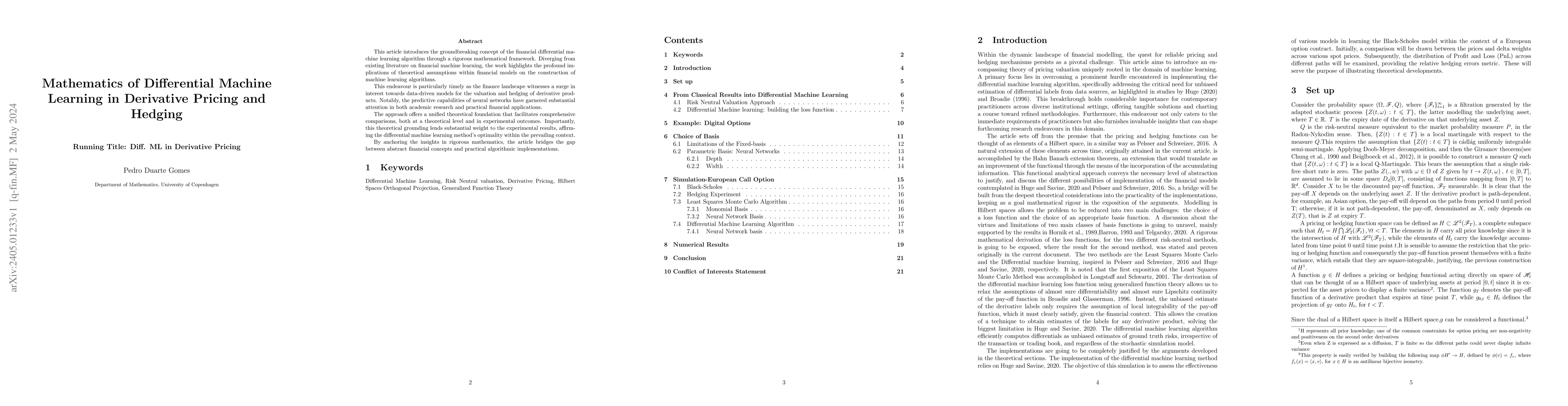

This article introduces the groundbreaking concept of the financial differential machine learning algorithm through a rigorous mathematical framework. Diverging from existing literature on financial machine learning, the work highlights the profound implications of theoretical assumptions within financial models on the construction of machine learning algorithms. This endeavour is particularly timely as the finance landscape witnesses a surge in interest towards data-driven models for the valuation and hedging of derivative products. Notably, the predictive capabilities of neural networks have garnered substantial attention in both academic research and practical financial applications. The approach offers a unified theoretical foundation that facilitates comprehensive comparisons, both at a theoretical level and in experimental outcomes. Importantly, this theoretical grounding lends substantial weight to the experimental results, affirming the differential machine learning method's optimality within the prevailing context. By anchoring the insights in rigorous mathematics, the article bridges the gap between abstract financial concepts and practical algorithmic implementations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApplying Reinforcement Learning to Option Pricing and Hedging

Zoran Stoiljkovic

Parametric Differential Machine Learning for Pricing and Calibration

Bernhard Hientzsch, Arun Kumar Polala

| Title | Authors | Year | Actions |

|---|

Comments (0)