Authors

Summary

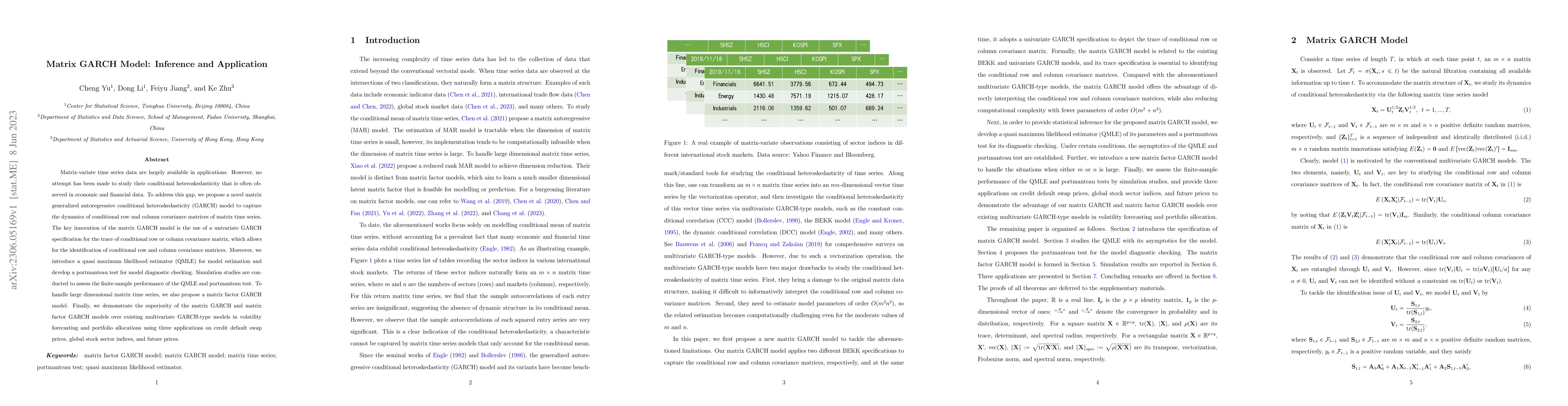

Matrix-variate time series data are largely available in applications. However, no attempt has been made to study their conditional heteroskedasticity that is often observed in economic and financial data. To address this gap, we propose a novel matrix generalized autoregressive conditional heteroskedasticity (GARCH) model to capture the dynamics of conditional row and column covariance matrices of matrix time series. The key innovation of the matrix GARCH model is the use of a univariate GARCH specification for the trace of conditional row or column covariance matrix, which allows for the identification of conditional row and column covariance matrices. Moreover, we introduce a quasi maximum likelihood estimator (QMLE) for model estimation and develop a portmanteau test for model diagnostic checking. Simulation studies are conducted to assess the finite-sample performance of the QMLE and portmanteau test. To handle large dimensional matrix time series, we also propose a matrix factor GARCH model. Finally, we demonstrate the superiority of the matrix GARCH and matrix factor GARCH models over existing multivariate GARCH-type models in volatility forecasting and portfolio allocations using three applications on credit default swap prices, global stock sector indices, and future prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVariational Inference for GARCH-family Models

Martin Magris, Alexandros Iosifidis

| Title | Authors | Year | Actions |

|---|

Comments (0)