Summary

In this note, we explicitly solve the problem of maximizing utility of consumption (until the minimum of bankruptcy and the time of death) with a constraint on the probability of lifetime ruin, which can be interpreted as a risk measure on the whole path of the wealth process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

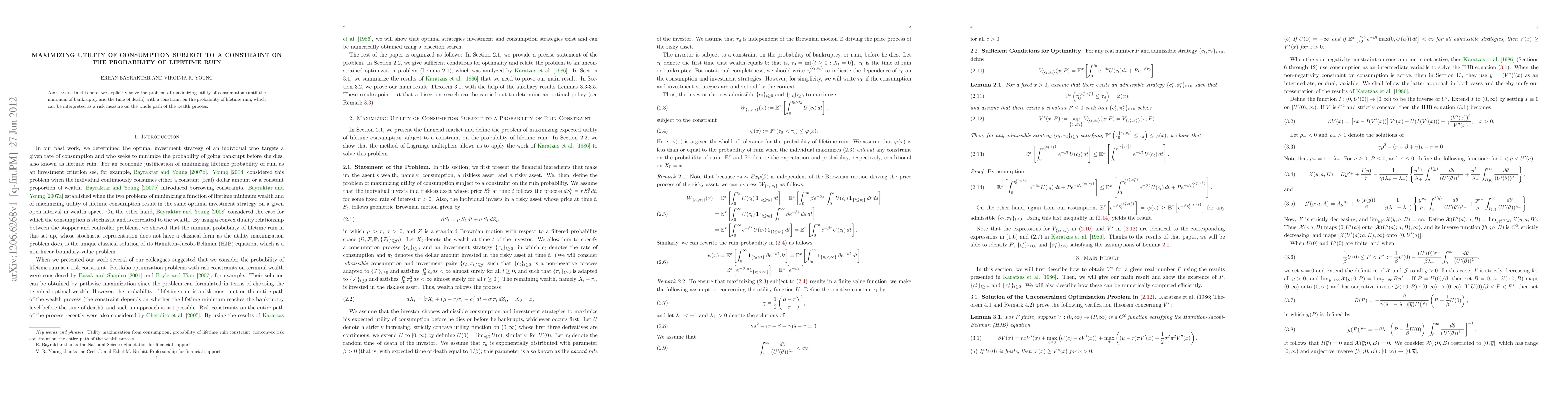

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)