Summary

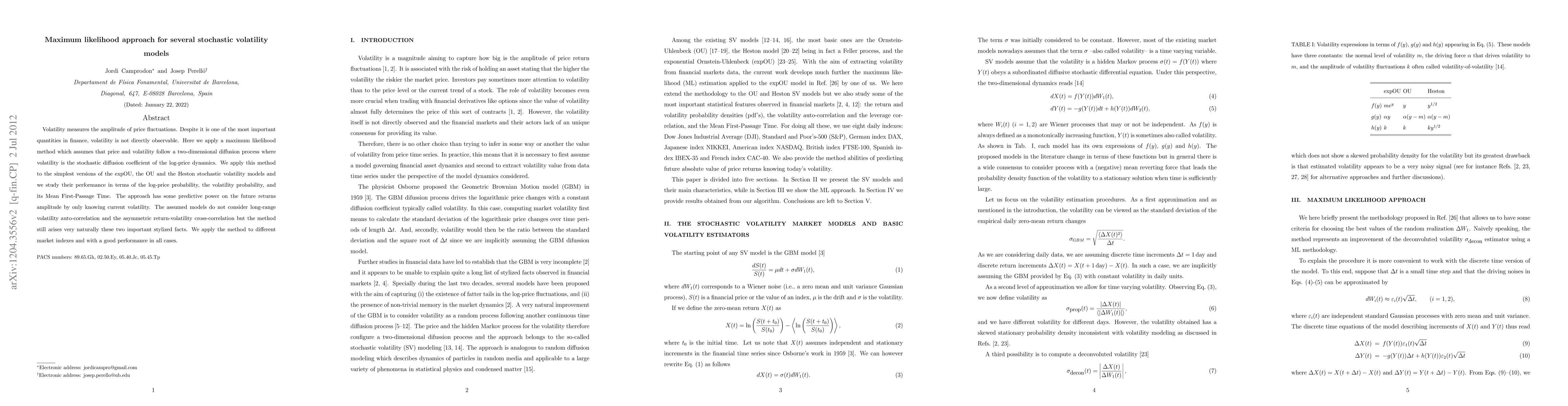

Volatility measures the amplitude of price fluctuations. Despite it is one of the most important quantities in finance, volatility is not directly observable. Here we apply a maximum likelihood method which assumes that price and volatility follow a two-dimensional diffusion process where volatility is the stochastic diffusion coefficient of the log-price dynamics. We apply this method to the simplest versions of the expOU, the OU and the Heston stochastic volatility models and we study their performance in terms of the log-price probability, the volatility probability, and its Mean First-Passage Time. The approach has some predictive power on the future returns amplitude by only knowing current volatility. The assumed models do not consider long-range volatility auto-correlation and the asymmetric return-volatility cross-correlation but the method still arises very naturally these two important stylized facts. We apply the method to different market indexes and with a good performance in all cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Quantum and Quantum-Inspired Maximum Likelihood Estimation and Filtering of Stochastic Volatility Models

Hamed Mohammadbagherpoor, Eric Ghysels, Jack Morgan

| Title | Authors | Year | Actions |

|---|

Comments (0)