Authors

Summary

We consider a novel class of portfolio liquidation games with market drop-out ("absorption"). More precisely, we consider mean-field and finite player liquidation games where a player drops out of the market when her position hits zero. In particular round-trips are not admissible. This can be viewed as a no statistical arbitrage condition. In a model with only sellers we prove that the absorption condition is equivalent to a short selling constraint. We prove that equilibria (both in the mean-field and the finite player game) are given as solutions to a non-linear higher-order integral equation with endogenous terminal condition. We prove the existence of a unique solution to the integral equation from which we obtain the existence of a unique equilibrium in the MFG and the existence of a unique equilibrium in the $N$-player game. We establish the convergence of the equilibria in the finite player games to the obtained mean-field equilibrium and illustrate the impact of the drop-out constraint on equilibrium trading rates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

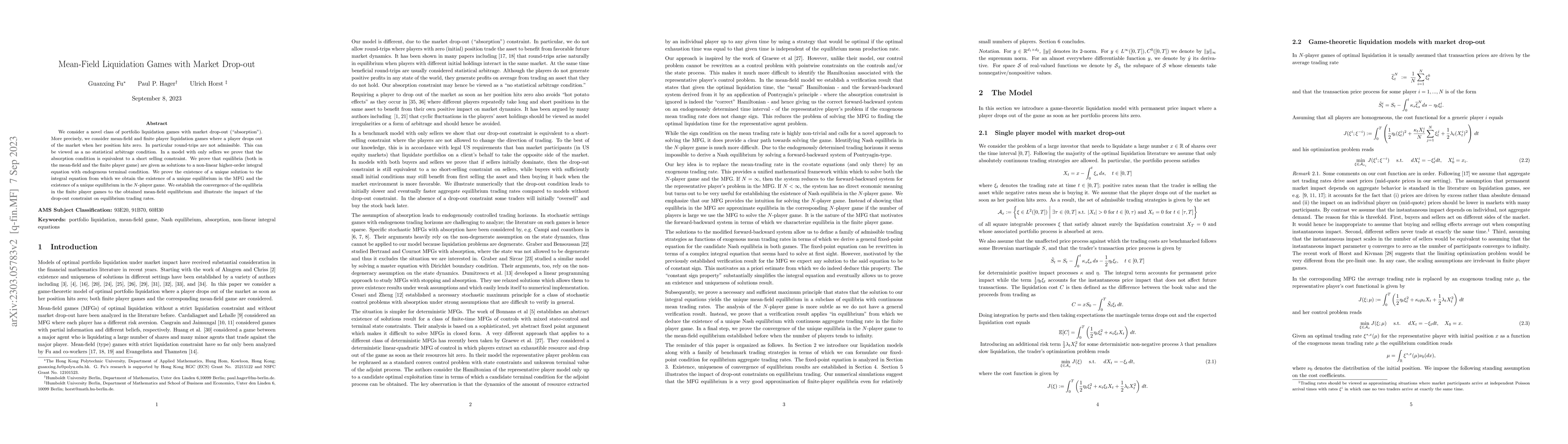

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Mean-Field Game of Market Entry: Portfolio Liquidation with Trading Constraints

Guanxing Fu, Paul P. Hager, Ulrich Horst

| Title | Authors | Year | Actions |

|---|

Comments (0)