Summary

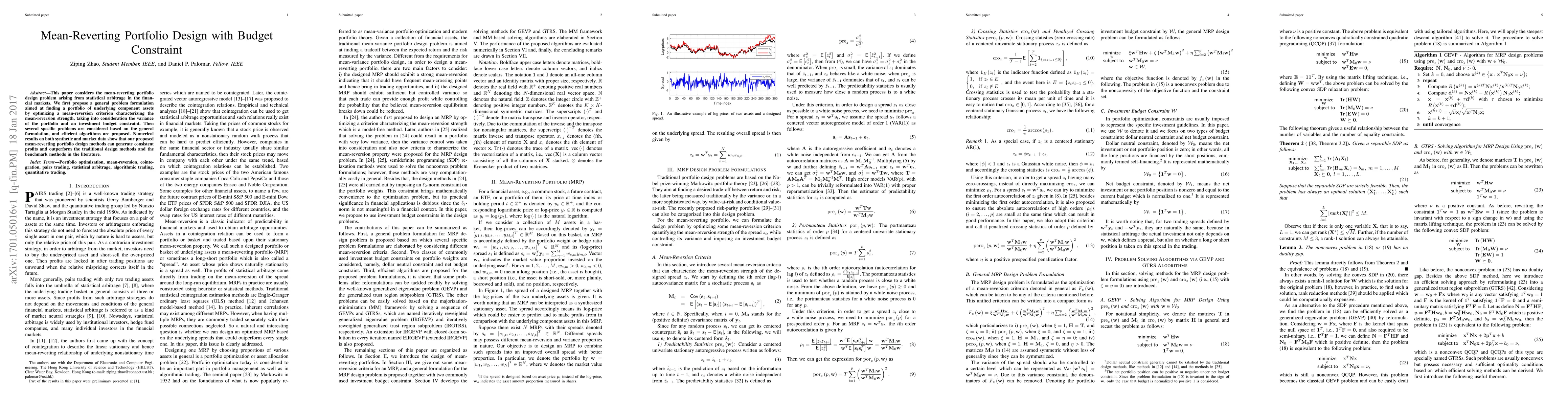

This paper considers the mean-reverting portfolio design problem arising from statistical arbitrage in the financial markets. We first propose a general problem formulation aimed at finding a portfolio of underlying component assets by optimizing a mean-reversion criterion characterizing the mean-reversion strength, taking into consideration the variance of the portfolio and an investment budget constraint. Then several specific problems are considered based on the general formulation, and efficient algorithms are proposed. Numerical results on both synthetic and market data show that our proposed mean-reverting portfolio design methods can generate consistent profits and outperform the traditional design methods and the benchmark methods in the literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)