Summary

Empirical studies indicate the existence of long range dependence in the volatility of the underlying asset. This feature can be captured by modeling its return and volatility using functions of a stationary fractional Ornstein--Uhlenbeck (fOU) process with Hurst index $H \in (\frac{1}{2}, 1)$. In this paper, we analyze the nonlinear optimal portfolio allocation problem under this model and in the regime where the fOU process is fast mean-reverting. We first consider the case of power utility, and rigorously give first order approximations of the value and the optimal strategy by a martingale distortion transformation. We also establish the asymptotic optimality in all admissible controls of a zeroth order trading strategy. Then, we extend the discussions to general utility functions using the epsilon-martingale decomposition technique, and we obtain similar asymptotic optimality results within a specific family of admissible strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

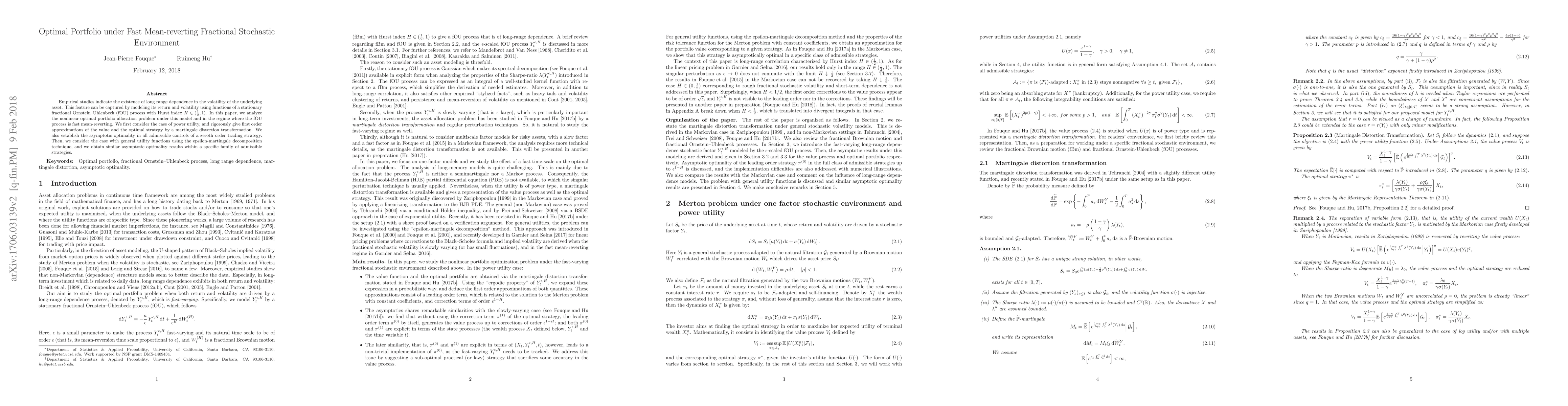

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)