Summary

Fractional stochastic volatility models have been widely used to capture the non-Markovian structure revealed from financial time series of realized volatility. On the other hand, empirical studies have identified scales in stock price volatility: both fast-time scale on the order of days and slow-scale on the order of months. So, it is natural to study the portfolio optimization problem under the effects of dependence behavior which we will model by fractional Brownian motions with Hurst index $H$, and in the fast or slow regimes characterized by small parameters $\eps$ or $\delta$. For the slowly varying volatility with $H \in (0,1)$, it was shown that the first order correction to the problem value contains two terms of order $\delta^H$, one random component and one deterministic function of state processes, while for the fast varying case with $H > \half$, the same form holds at order $\eps^{1-H}$. This paper is dedicated to the remaining case of a fast-varying rough environment ($H < \half$) which exhibits a different behavior. We show that, in the expansion, only one deterministic term of order $\sqrt{\eps}$ appears in the first order correction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

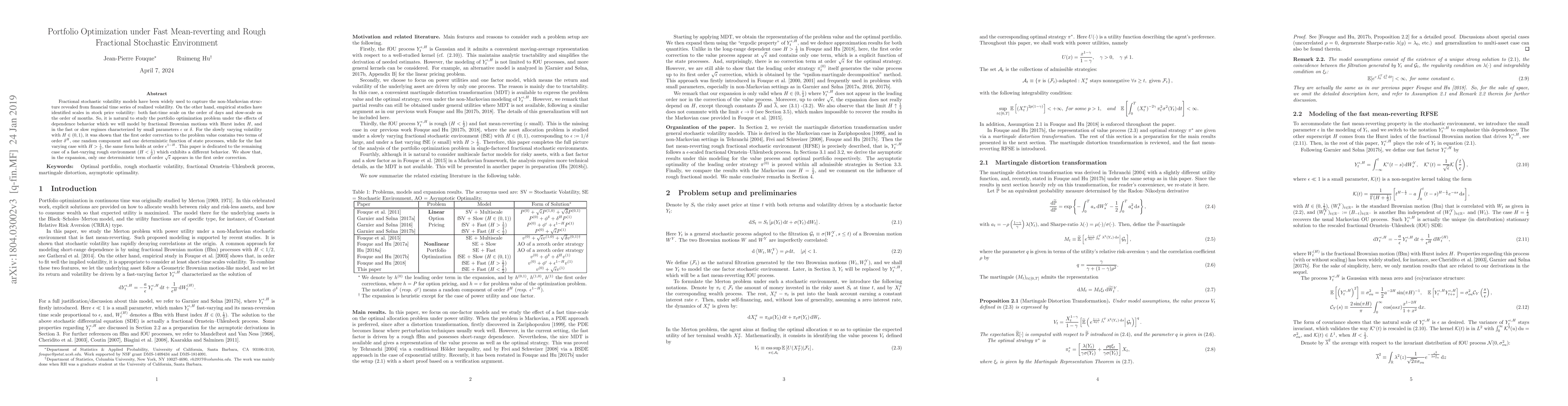

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)