Summary

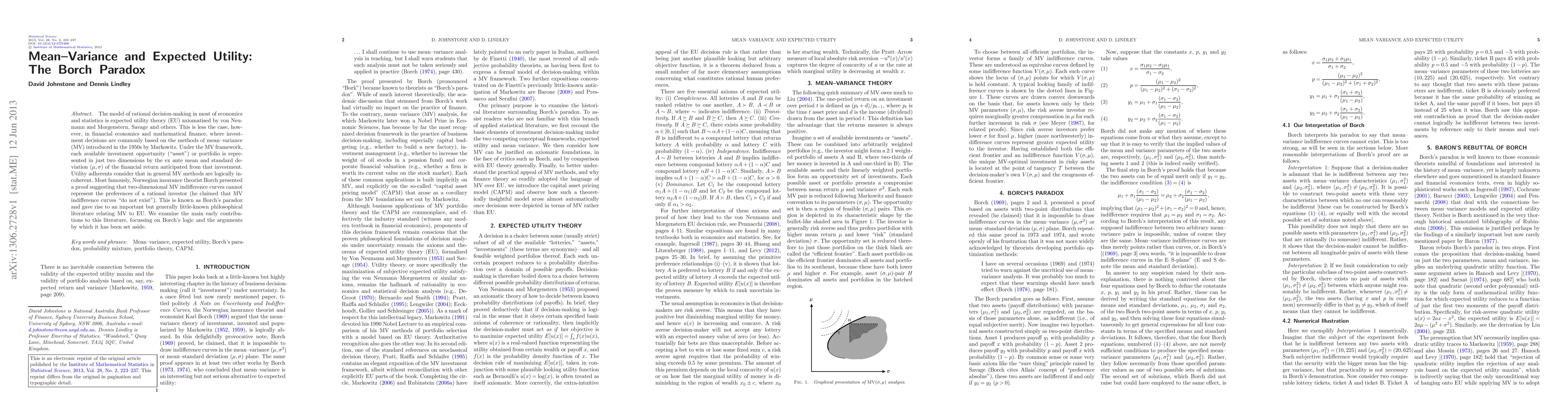

The model of rational decision-making in most of economics and statistics is expected utility theory (EU) axiomatised by von Neumann and Morgenstern, Savage and others. This is less the case, however, in financial economics and mathematical finance, where investment decisions are commonly based on the methods of mean-variance (MV) introduced in the 1950s by Markowitz. Under the MV framework, each available investment opportunity ("asset") or portfolio is represented in just two dimensions by the ex ante mean and standard deviation $(\mu,\sigma)$ of the financial return anticipated from that investment. Utility adherents consider that in general MV methods are logically incoherent. Most famously, Norwegian insurance theorist Borch presented a proof suggesting that two-dimensional MV indifference curves cannot represent the preferences of a rational investor (he claimed that MV indifference curves "do not exist"). This is known as Borch's paradox and gave rise to an important but generally little-known philosophical literature relating MV to EU. We examine the main early contributions to this literature, focussing on Borch's logic and the arguments by which it has been set aside.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMean-Variance Efficiency of Optimal Power and Logarithmic Utility Portfolios

Taras Bodnar, Nestor Parolya, Dmytro Ivasiuk et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)