Summary

In this paper, we propose a new class of optimization problems, which maximize the terminal wealth and accumulated consumption utility subject to a mean variance criterion controlling the final risk of the portfolio. The multiple-objective optimization problem is firstly transformed into a single-objective one by introducing the concept of overall "happiness" of an investor defined as the aggregation of the terminal wealth under the mean-variance criterion and the expected accumulated utility, and then solved under a game theoretic framework. We have managed to maintain analytical tractability; the closed-form solutions found for a set of special utility functions enable us to discuss some interesting optimal investment strategies that have not been revealed before in literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

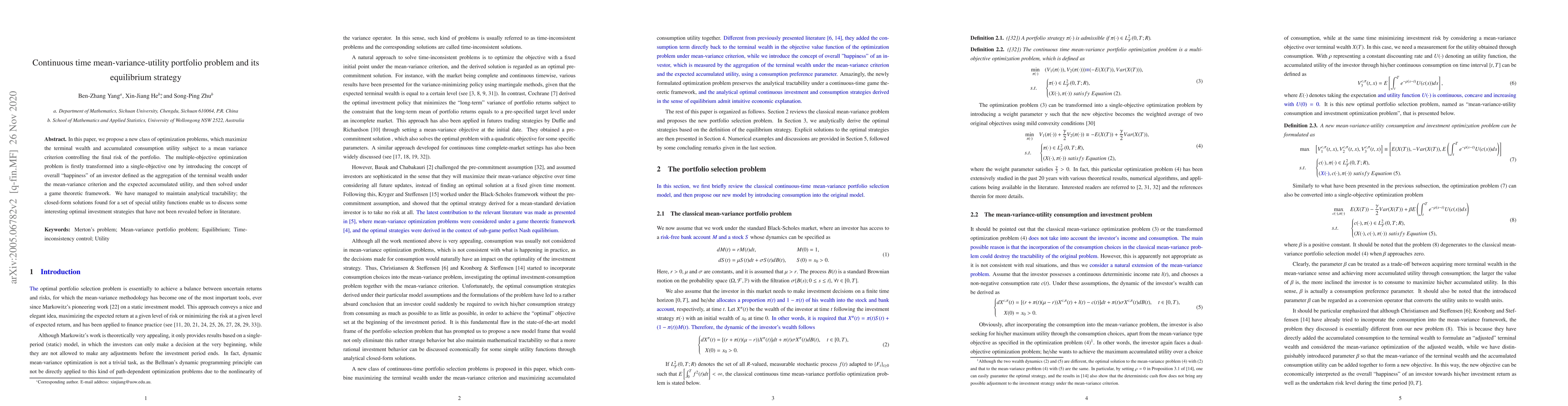

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust equilibrium strategy for mean-variance-skewness portfolio selection problem

Zhihao Hu, Nan-jing Huang, Jian-hao Kang et al.

Robust Equilibrium Strategy for Mean-Variance Portfolio Selection

Chao Zhou, Mengge Li, Shuaijie Qian

| Title | Authors | Year | Actions |

|---|

Comments (0)