Authors

Summary

This paper studies the continuous time mean-variance portfolio selection problem with one kind of non-linear wealth dynamics. To deal the expectation constraint, an auxiliary stochastic control problem is firstly solved by two new generalized stochastic Riccati equations from which a candidate portfolio in feedback form is constructed, and the corresponding wealth process will never cross the vertex of the parabola. In order to verify the optimality of the candidate portfolio, the convex duality (requires the monotonicity of the cost function) is established to give another more direct expression of the terminal wealth level. The variance-optimal martingale measure and the link between the non-linear financial market and the classical linear market are also provided. Finally, we obtain the efficient frontier in closed form. From our results, people are more likely to invest their money in riskless asset compared with the classical linear market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

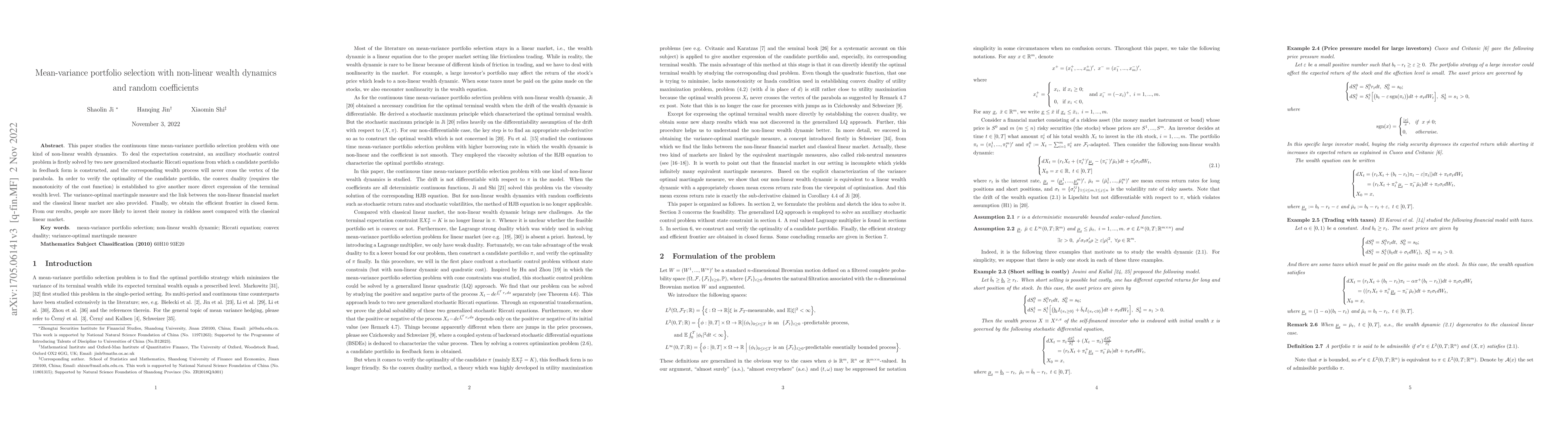

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)