Summary

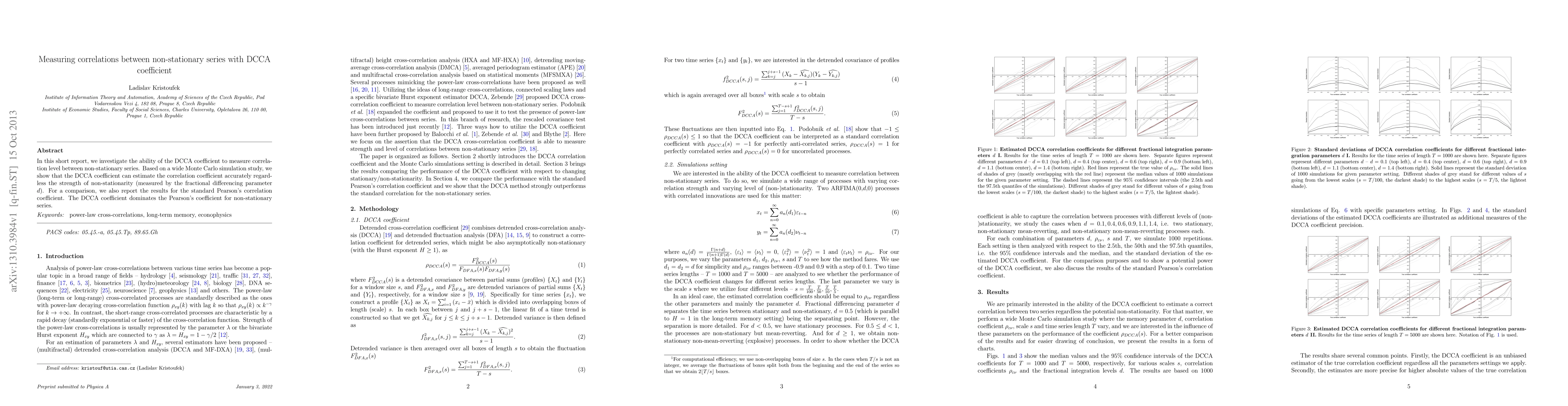

In this short report, we investigate the ability of the DCCA coefficient to measure correlation level between non-stationary series. Based on a wide Monte Carlo simulation study, we show that the DCCA coefficient can estimate the correlation coefficient accurately regardless the strength of non-stationarity (measured by the fractional differencing parameter $d$). For a comparison, we also report the results for the standard Pearson's correlation coefficient. The DCCA coefficient dominates the Pearson's coefficient for non-stationary series.

AI Key Findings

Generated Sep 07, 2025

Methodology

The research employs a Monte Carlo simulation study to evaluate the DCCA coefficient's performance in measuring correlation between non-stationary series, varying parameters such as memory (d), correlation coefficient (ρεν), scales (s), and time series length (T).

Key Results

- DCCA coefficient accurately estimates the correlation coefficient for non-stationary series, regardless of the strength of non-stationarity (measured by the fractional differencing parameter d).

- DCCA coefficient outperforms Pearson's correlation coefficient for non-stationary series, showing less bias and narrower confidence intervals.

Significance

This research is important as it validates the DCCA coefficient as a reliable tool for measuring correlations between non-stationary time series, which is crucial for various fields like finance, climate science, and engineering.

Technical Contribution

The paper demonstrates that the DCCA coefficient is an unbiased and precise estimator of the true correlation coefficient for non-stationary series, even under varying levels of non-stationarity and time series lengths.

Novelty

The research builds upon and extends previous work by Zebende [29] and Podobnik et al. [18], providing further evidence of the DCCA coefficient's effectiveness in measuring correlations between non-stationary time series.

Limitations

- The study is limited to a Monte Carlo simulation approach, and real-world applications may present additional complexities.

- The research focuses on specific types of non-stationary series and does not explore the coefficient's performance on other types of non-stationary data.

Future Work

- Investigate the DCCA coefficient's performance on diverse non-stationary datasets from different domains.

- Explore the applicability of DCCA in estimating correlations in the presence of structural breaks or regime changes in time series.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the behavior of the DFA and DCCA in trend-stationary processes

Guilherme Pumi, Taiane Schaedler Prass

| Title | Authors | Year | Actions |

|---|

Comments (0)