Authors

Summary

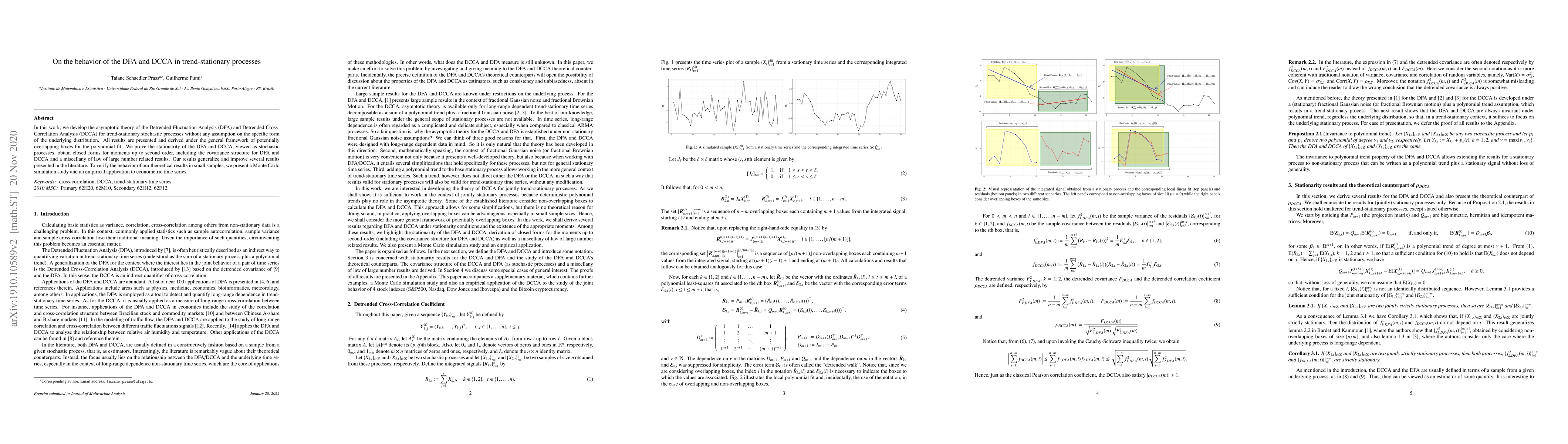

In this work, we develop the asymptotic theory of the Detrended Fluctuation Analysis (DFA) and Detrended Cross-Correlation Analysis (DCCA) for trend-stationary stochastic processes without any assumption on the specific form of the underlying distribution. All results are presented and derived under the general framework of potentially overlapping boxes for the polynomial fit. We prove the stationarity of the DFA and DCCA, viewed as stochastic processes, obtain closed forms for moments up to second order, including the covariance structure for DFA and DCCA and a miscellany of law of large number related results. Our results generalize and improve several results presented in the literature. To verify the behavior of our theoretical results in small samples, we present a Monte Carlo simulation study and an empirical application to econometric time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)