Summary

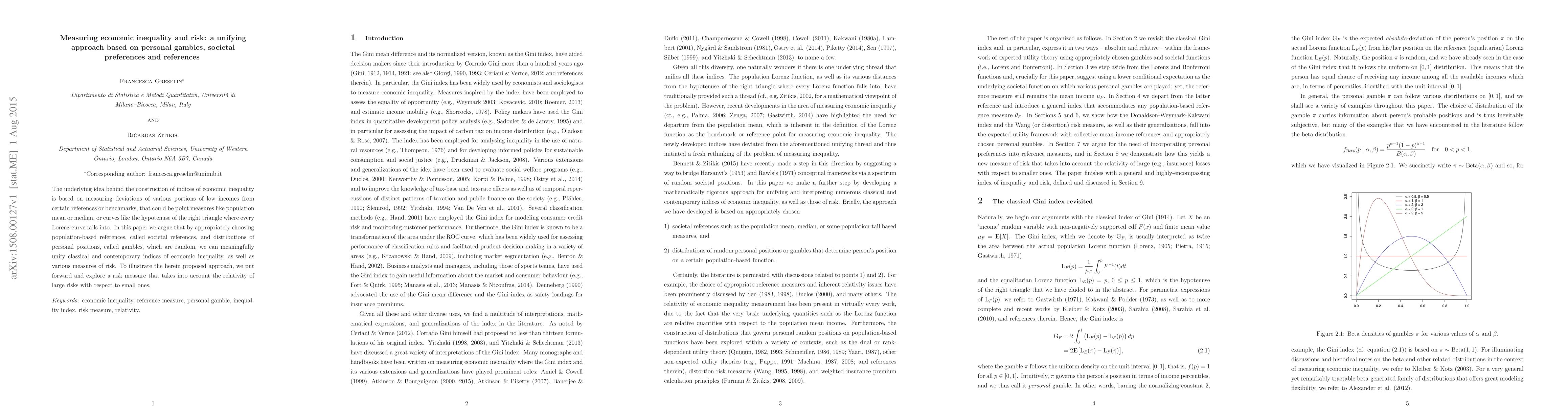

The underlying idea behind the construction of indices of economic inequality is based on measuring deviations of various portions of low incomes from certain references or benchmarks, that could be point measures like population mean or median, or curves like the hypotenuse of the right triangle where every Lorenz curve falls into. In this paper we argue that by appropriately choosing population-based references, called societal references, and distributions of personal positions, called gambles, which are random, we can meaningfully unify classical and contemporary indices of economic inequality, as well as various measures of risk. To illustrate the herein proposed approach, we put forward and explore a risk measure that takes into account the relativity of large risks with respect to small ones.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDistinguishing Risk Preferences using Repeated Gambles

James Price, Colm Connaughton

Evaluating and Aligning Human Economic Risk Preferences in LLMs

Yi Yang, Jiaxin Liu, Kar Yan Tam

Heat and Economic Preferences

David Johnston, Rachel Knott, Michelle Escobar Carias et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)