Summary

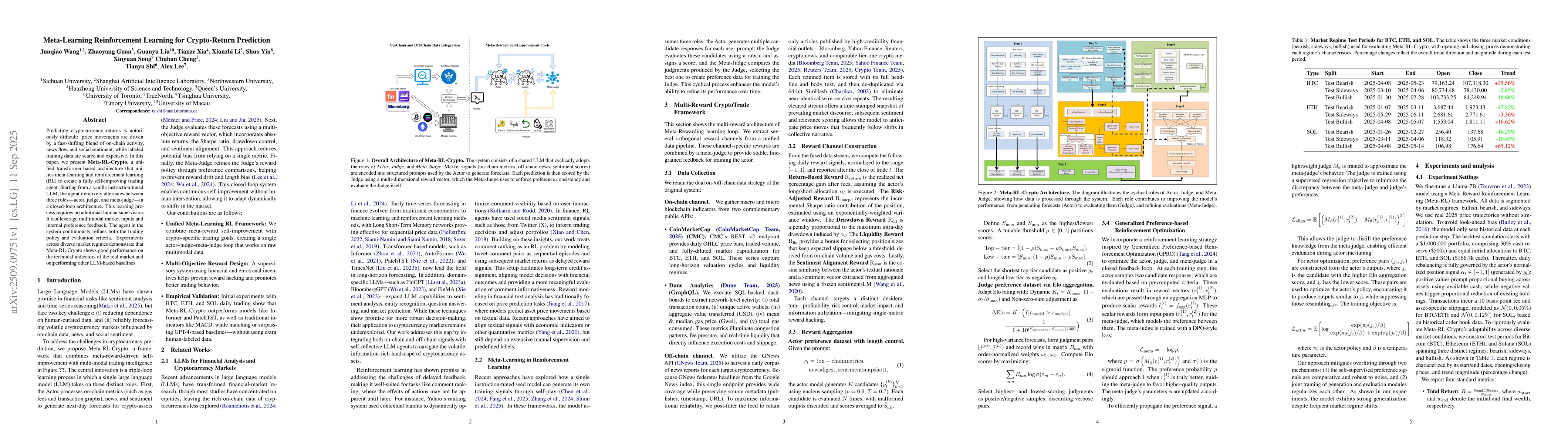

Predicting cryptocurrency returns is notoriously difficult: price movements are driven by a fast-shifting blend of on-chain activity, news flow, and social sentiment, while labeled training data are scarce and expensive. In this paper, we present Meta-RL-Crypto, a unified transformer-based architecture that unifies meta-learning and reinforcement learning (RL) to create a fully self-improving trading agent. Starting from a vanilla instruction-tuned LLM, the agent iteratively alternates between three roles-actor, judge, and meta-judge-in a closed-loop architecture. This learning process requires no additional human supervision. It can leverage multimodal market inputs and internal preference feedback. The agent in the system continuously refines both the trading policy and evaluation criteria. Experiments across diverse market regimes demonstrate that Meta-RL-Crypto shows good performance on the technical indicators of the real market and outperforming other LLM-based baselines.

AI Key Findings

Generated Oct 18, 2025

Methodology

The paper introduces Meta-RL-Crypto, a transformer-based architecture combining meta-learning and reinforcement learning. It employs a closed-loop system with three roles: actor, judge, and meta-judge. The model uses multi-reward signals from on-chain and off-chain data, along with sentiment analysis, to refine trading policies through iterative self-improvement.

Key Results

- Meta-RL-Crypto outperforms existing LLM-based baselines in cryptocurrency return prediction, achieving a total return of -8% in bear markets compared to -12% to -22% for baselines.

- The model demonstrates superior risk-adjusted returns with a Sharpe ratio of 0.30, surpassing other models across different market conditions.

- It achieves high scores in market interpretability metrics (0.82±0.07, 0.85±0.06, 0.88±0.05) for market relevance, risk awareness, and adaptive rationale.

Significance

This research advances AI applications in cryptocurrency prediction by providing a self-improving system that adapts to dynamic market conditions. It offers significant improvements over traditional models and sets a new benchmark for financial AI systems.

Technical Contribution

The paper introduces a multi-objective reward design that incorporates profitability, risk control, liquidity, and sentiment alignment, preventing reward hacking and improving overall trading behavior.

Novelty

The novelty lies in the combination of meta-learning and reinforcement learning within a closed-loop system, along with the use of multi-reward signals from both on-chain and off-chain data sources to enhance market volatility and complexity capture.

Limitations

- The model relies on historical data and may not fully account for future market shifts or extreme events.

- The complexity of the multi-reward system could pose challenges in real-time implementation.

Future Work

- Exploring the integration of real-time market data and adaptive reward mechanisms.

- Investigating the application of this framework to other financial markets beyond cryptocurrencies.

Paper Details

PDF Preview

Similar Papers

Found 5 papersThe Recurrent Reinforcement Learning Crypto Agent

Paolo Barucca, Nick Firoozye, Gabriel Borrageiro

Modelling crypto markets by multi-agent reinforcement learning

Stefano Palminteri, Boris Gutkin, Johann Lussange et al.

Comments (0)