Authors

Summary

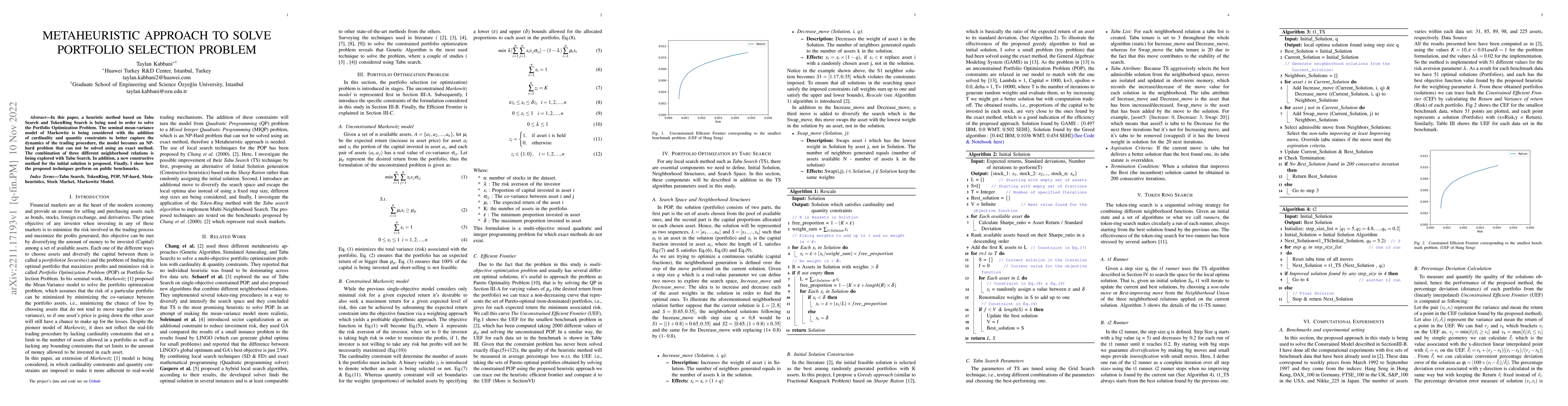

In this paper, a heuristic method based on TabuSearch and TokenRing Search is being used in order to solve the Portfolio Optimization Problem. The seminal mean-variance model of Markowitz is being considered with the addition of cardinality and quantity constraints to better capture the dynamics of the trading procedure, the model becomes an NP-hard problem that can not be solved using an exact method. The combination of three different neighborhood relations is being explored with Tabu Search. In addition, a new constructive method for the initial solution is proposed. Finally, I show how the proposed techniques perform on public benchmarks

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)