Summary

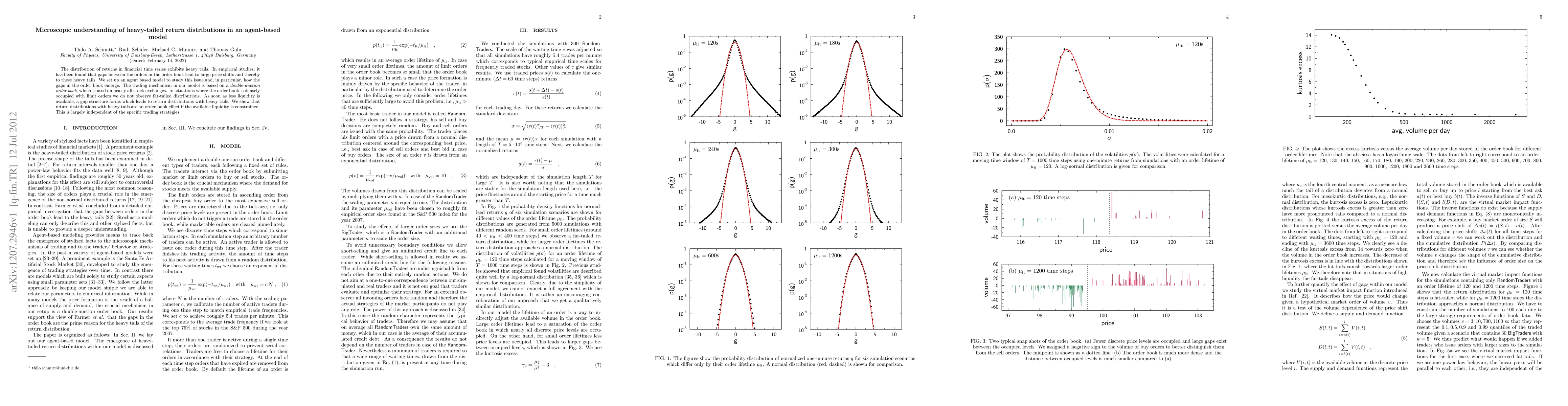

The distribution of returns in financial time series exhibits heavy tails. In empirical studies, it has been found that gaps between the orders in the order book lead to large price shifts and thereby to these heavy tails. We set up an agent based model to study this issue and, in particular, how the gaps in the order book emerge. The trading mechanism in our model is based on a double-auction order book, which is used on nearly all stock exchanges. In situations where the order book is densely occupied with limit orders we do not observe fat-tailed distributions. As soon as less liquidity is available, a gap structure forms which leads to return distributions with heavy tails. We show that return distributions with heavy tails are an order-book effect if the available liquidity is constrained. This is largely independent of the specific trading strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHeavy-tailed probability distributions in social sciences

Lev B. Klebanov, Yulia V. Kuvaeva

| Title | Authors | Year | Actions |

|---|

Comments (0)