Summary

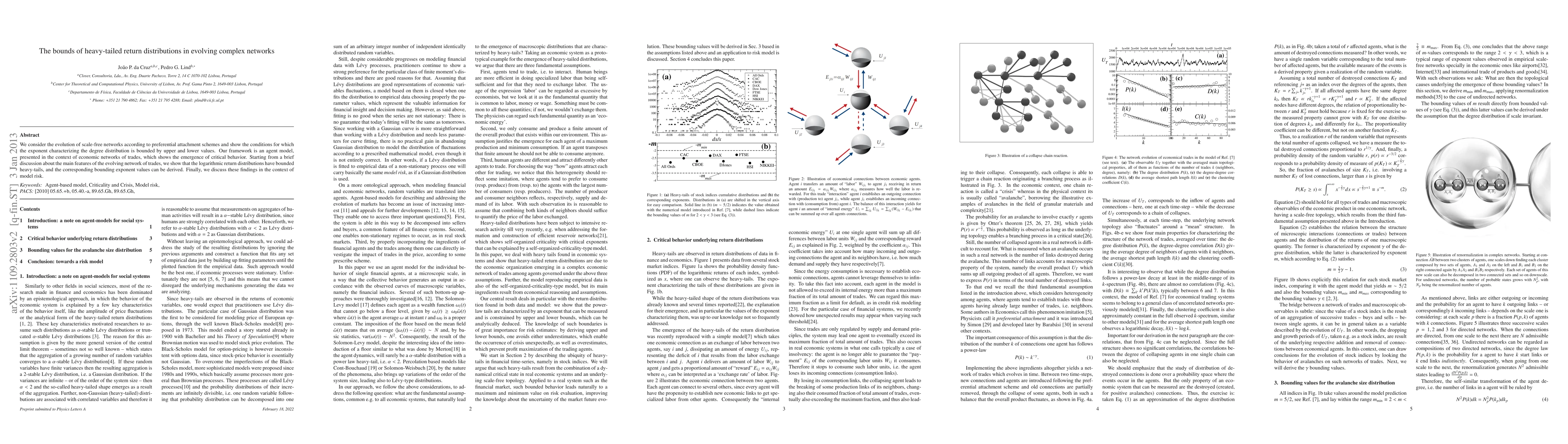

We consider the evolution of scale-free networks according to preferential attachment schemes and show the conditions for which the exponent characterizing the degree distribution is bounded by upper and lower values. Our framework is an agent model, presented in the context of economic networks of trades, which shows the emergence of critical behavior. Starting from a brief discussion about the main features of the evolving network of trades, we show that the logarithmic return distributions have bounded heavy-tails, and the corresponding bounding exponent values can be derived. Finally, we discuss these findings in the context of model risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)