Summary

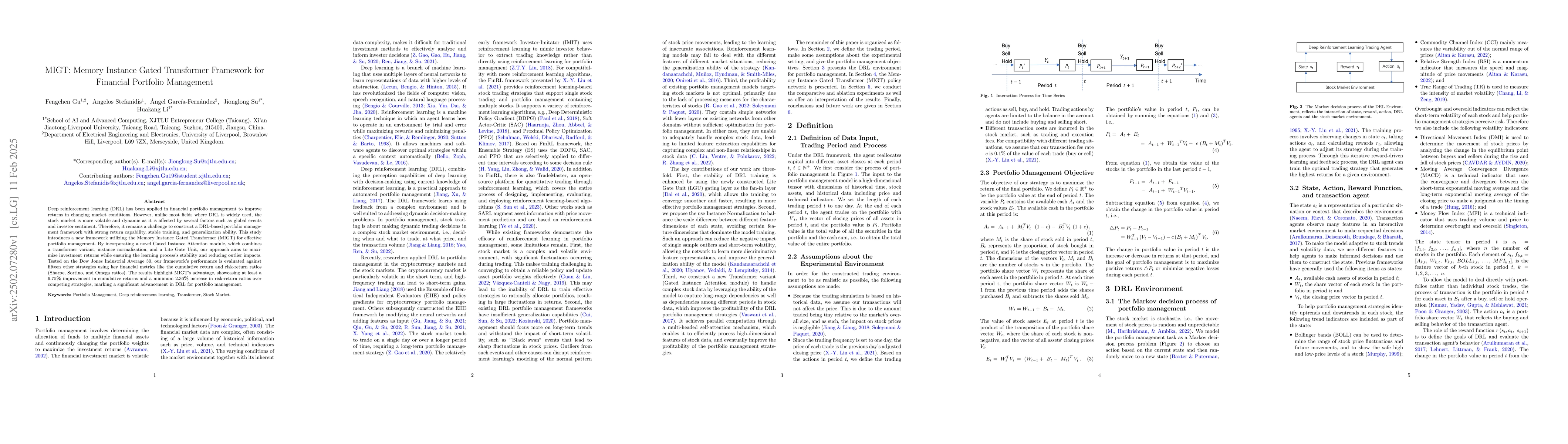

Deep reinforcement learning (DRL) has been applied in financial portfolio management to improve returns in changing market conditions. However, unlike most fields where DRL is widely used, the stock market is more volatile and dynamic as it is affected by several factors such as global events and investor sentiment. Therefore, it remains a challenge to construct a DRL-based portfolio management framework with strong return capability, stable training, and generalization ability. This study introduces a new framework utilizing the Memory Instance Gated Transformer (MIGT) for effective portfolio management. By incorporating a novel Gated Instance Attention module, which combines a transformer variant, instance normalization, and a Lite Gate Unit, our approach aims to maximize investment returns while ensuring the learning process's stability and reducing outlier impacts. Tested on the Dow Jones Industrial Average 30, our framework's performance is evaluated against fifteen other strategies using key financial metrics like the cumulative return and risk-return ratios (Sharpe, Sortino, and Omega ratios). The results highlight MIGT's advantage, showcasing at least a 9.75% improvement in cumulative returns and a minimum 2.36% increase in risk-return ratios over competing strategies, marking a significant advancement in DRL for portfolio management.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research introduces MIGT, a novel framework for portfolio management using Deep Reinforcement Learning (DRL) that incorporates a Gated Instance Attention module combining a Transformer variant, instance normalization, and a Lite Gate Unit to enhance profitability and convergence for effective strategies.

Key Results

- MIGT outperforms fifteen competing strategies with at least a 9.75% improvement in cumulative returns.

- MIGT shows a minimum 2.36% increase in risk-return ratios (Sharpe, Sortino, and Omega ratios) compared to competing strategies.

- MIGT demonstrates higher probability of obtaining positive returns and stronger sustained profitability over the same task and dataset.

Significance

This research is significant as it presents a DRL-based portfolio management framework that effectively handles multi-dimensional data, ensuring higher stability of reinforcement learning, less influence of outliers, and a larger range of time series data processing.

Technical Contribution

The introduction of the Gated Instance Attention module, which combines a Transformer variant, instance normalization, and Lite Gate Unit, enhances the profitability and convergence of DRL strategies for portfolio management.

Novelty

MIGT stands out due to its Memory Instance Gated Transformer framework, which effectively addresses the challenges of volatility and dynamism in the stock market, providing a significant advancement in DRL for portfolio management.

Limitations

- The advantage of MIGT is less significant in terms of the Omega ratio, which accounts for risk-adjusted returns.

- The framework's risk modeling capabilities can be further improved by incorporating additional risk factors as inputs.

- The neural network architecture and reinforcement learning algorithm can be optimized further for stock data and stock market characteristics.

Future Work

- Expand risk modeling capabilities by incorporating additional risk factors as inputs.

- Optimize the neural network architecture and reinforcement learning algorithm for stock data and stock market characteristics.

- Enable flexible mixed long/short positions to allow the reinforcement learning agent to learn more advanced strategies with improved performance in both bull and bear regimes.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDeep Reinforcement Learning for ESG financial portfolio management

Eduardo C. Garrido-Merchán, Sol Mora-Figueroa-Cruz-Guzmán, María Coronado-Vaca

No citations found for this paper.

Comments (0)