Summary

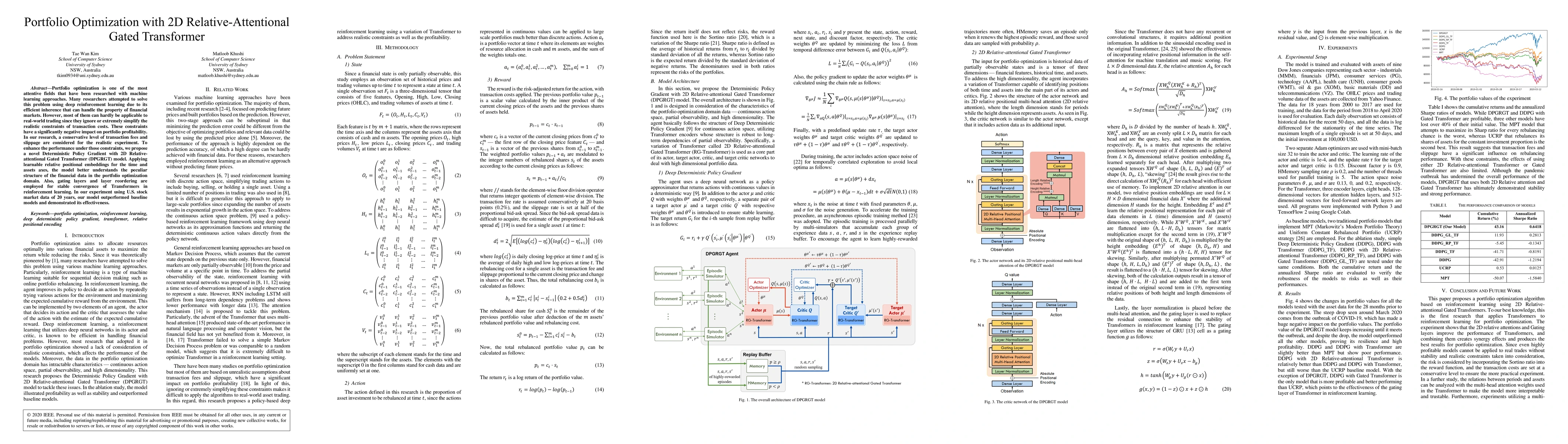

Portfolio optimization is one of the most attentive fields that have been researched with machine learning approaches. Many researchers attempted to solve this problem using deep reinforcement learning due to its efficient inherence that can handle the property of financial markets. However, most of them can hardly be applicable to real-world trading since they ignore or extremely simplify the realistic constraints of transaction costs. These constraints have a significantly negative impact on portfolio profitability. In our research, a conservative level of transaction fees and slippage are considered for the realistic experiment. To enhance the performance under those constraints, we propose a novel Deterministic Policy Gradient with 2D Relative-attentional Gated Transformer (DPGRGT) model. Applying learnable relative positional embeddings for the time and assets axes, the model better understands the peculiar structure of the financial data in the portfolio optimization domain. Also, gating layers and layer reordering are employed for stable convergence of Transformers in reinforcement learning. In our experiment using U.S. stock market data of 20 years, our model outperformed baseline models and demonstrated its effectiveness.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMIGT: Memory Instance Gated Transformer Framework for Financial Portfolio Management

Angelos Stefanidis, Jionglong Su, Fengchen Gu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)