Summary

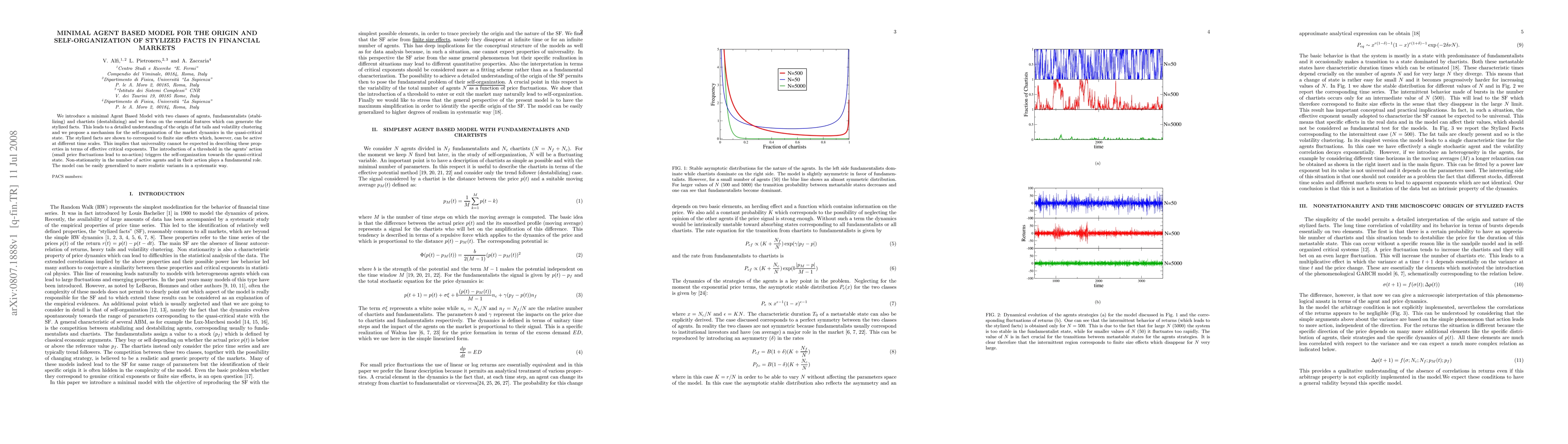

We introduce a minimal Agent Based Model with two classes of agents, fundamentalists (stabilizing) and chartists (destabilizing) and we focus on the essential features which can generate the stylized facts. This leads to a detailed understanding of the origin of fat tails and volatility clustering and we propose a mechanism for the self-organization of the market dynamics in the quasi-critical state. The stylized facts are shown to correspond to finite size effects which, however, can be active at different time scales. This implies that universality cannot be expected in describing these properties in terms of effective critical exponents. The introduction of a threshold in the agents' action (small price fluctuations lead to no-action) triggers the self-organization towards the quasi-critical state. Non-stationarity in the number of active agents and in their action plays a fundamental role. The model can be easily generalized to more realistic variants in a systematic way.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInternational Financial Markets Through 150 Years: Evaluating Stylized Facts

Maximilian Janisch, Thomas Lehéricy, Sara A. Safari

| Title | Authors | Year | Actions |

|---|

Comments (0)