Summary

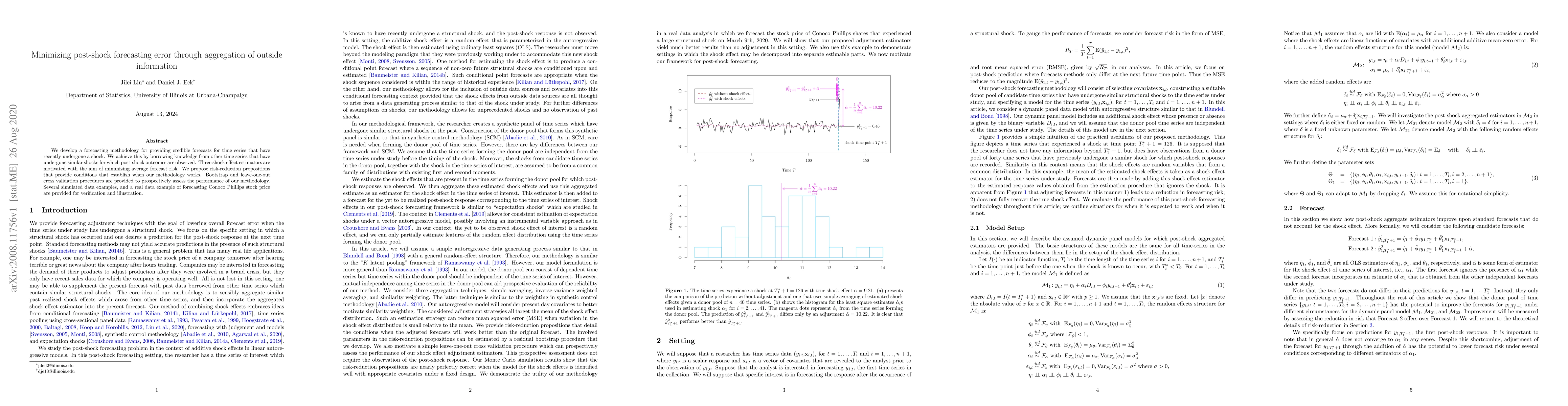

We develop a forecasting methodology for providing credible forecasts for time series that have recently undergone a shock. We achieve this by borrowing knowledge from other time series that have undergone similar shocks for which post-shock outcomes are observed. Three shock effect estimators are motivated with the aim of minimizing average forecast risk. We propose risk-reduction propositions that provide conditions that establish when our methodology works. Bootstrap and leave-one-out cross validation procedures are provided to prospectively assess the performance of our methodology. Several simulated data examples, and a real data example of forecasting Conoco Phillips stock price are provided for verification and illustration.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel aggregation: minimizing empirical variance outperforms minimizing empirical error

Houman Owhadi, Théo Bourdais

Volatility Forecasting Using Similarity-based Parameter Correction and Aggregated Shock Information

David P. Lundquist, Daniel J. Eck

Optimal Compression for Minimizing Classification Error Probability: an Information-Theoretic Approach

Jingchao Gao, Weiyu Xu, Ao Tang

| Title | Authors | Year | Actions |

|---|

Comments (0)