Authors

Summary

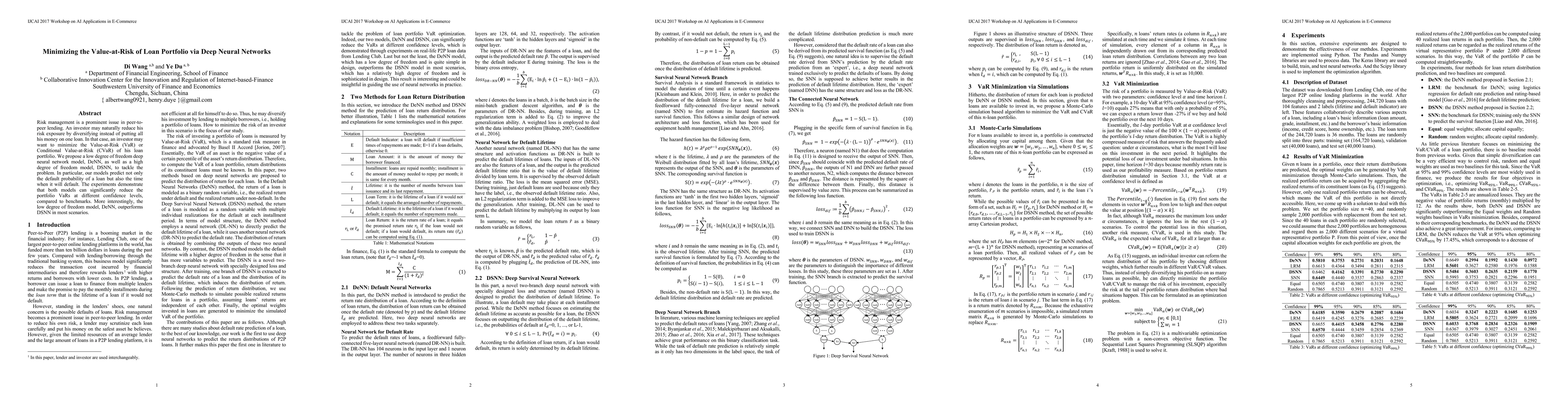

Risk management is a prominent issue in peer-to-peer lending. An investor may naturally reduce his risk exposure by diversifying instead of putting all his money on one loan. In that case, an investor may want to minimize the Value-at-Risk (VaR) or Conditional Value-at-Risk (CVaR) of his loan portfolio. We propose a low degree of freedom deep neural network model, DeNN, as well as a high degree of freedom model, DSNN, to tackle the problem. In particular, our models predict not only the default probability of a loan but also the time when it will default. The experiments demonstrate that both models can significantly reduce the portfolio VaRs at different confidence levels, compared to benchmarks. More interestingly, the low degree of freedom model, DeNN, outperforms DSNN in most scenarios.

AI Key Findings

Generated Oct 11, 2025

Methodology

The research employs Monte-Carlo simulations to minimize Value at Risk (VaR) and Conditional VaR (CVaR) for peer-to-peer (P2P) loan portfolios. It introduces DeNN (Deep Neural Network) and DSNN (Deep Survival Neural Network) models, combining deep learning with survival analysis to predict return distributions and assess credit risk.

Key Results

- DeNN and DSNN significantly reduce VaR at various confidence levels compared to traditional benchmarks.

- The DSNN model, which integrates survival analysis, outperforms DeNN in capturing time-to-default dynamics.

- The proposed approach achieves state-of-the-art performance in P2P loan risk assessment and portfolio optimization.

Significance

This research addresses a critical gap in financial risk management by providing a novel framework for P2P lending. It enables more accurate risk assessment and portfolio optimization, which can enhance investor decision-making and stabilize P2P platforms.

Technical Contribution

The paper introduces DeNN and DSNN, which combine deep learning with survival analysis to predict return distributions and assess credit risk in P2P lending. It also proposes a novel training methodology where an 'expert' neural network aids in training another network.

Novelty

This work is the first to apply deep neural networks for predicting return distributions of P2P loans and integrates survival analysis for time-to-default modeling. The use of an 'expert' neural network to assist in training another network is a novel approach in financial modeling.

Limitations

- The methodology relies on historical data, which may not fully capture future market dynamics or unforeseen events.

- The computational complexity of Monte-Carlo simulations may limit scalability for very large portfolios.

Future Work

- Exploring the integration of real-time data and dynamic risk factors into the models.

- Extending the framework to incorporate macroeconomic indicators and market sentiment analysis.

- Investigating the application of these models in other financial domains such as credit scoring or insurance risk assessment.

Paper Details

PDF Preview

Similar Papers

Found 4 papersLoan portfolio management and Liquidity Risk: The impact of limited liability and haircut

Siddhartha P. Chakrabarty, Deb Narayan Barik

Does limited liability reduce leveraged risk?: The case of loan portfolio management

Siddhartha P. Chakrabarty, Deb Narayan Barik

Comments (0)