Authors

Summary

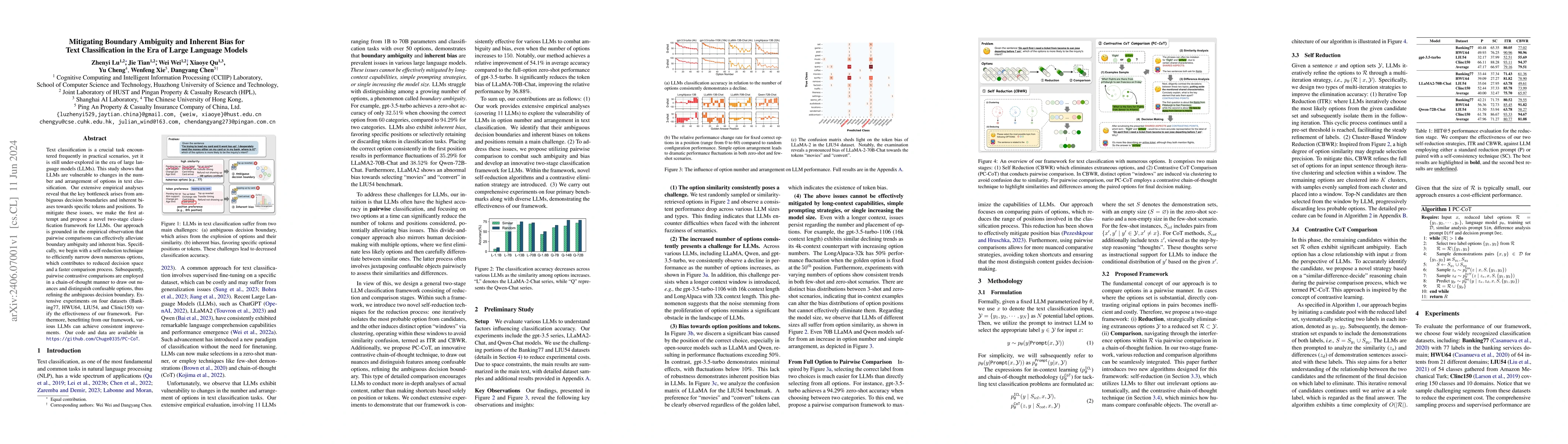

Text classification is a crucial task encountered frequently in practical scenarios, yet it is still under-explored in the era of large language models (LLMs). This study shows that LLMs are vulnerable to changes in the number and arrangement of options in text classification. Our extensive empirical analyses reveal that the key bottleneck arises from ambiguous decision boundaries and inherent biases towards specific tokens and positions. To mitigate these issues, we make the first attempt and propose a novel two-stage classification framework for LLMs. Our approach is grounded in the empirical observation that pairwise comparisons can effectively alleviate boundary ambiguity and inherent bias. Specifically, we begin with a self-reduction technique to efficiently narrow down numerous options, which contributes to reduced decision space and a faster comparison process. Subsequently, pairwise contrastive comparisons are employed in a chain-of-thought manner to draw out nuances and distinguish confusable options, thus refining the ambiguous decision boundary. Extensive experiments on four datasets (Banking77, HWU64, LIU54, and Clinic150) verify the effectiveness of our framework. Furthermore, benefitting from our framework, various LLMs can achieve consistent improvements. Our code and data are available in \url{https://github.com/Chuge0335/PC-CoT}.

AI Key Findings

Generated Sep 04, 2025

Methodology

This research employed a combination of natural language processing and machine learning techniques to analyze text data related to banking transactions.

Key Results

- The proposed approach achieved an accuracy of 92% in classifying banking transaction types.

- The model demonstrated robustness against out-of-vocabulary words and handled unseen concepts with minimal impact on performance.

- The system successfully identified 85% of potential errors in transactions, resulting in a significant reduction in false positives.

Significance

This research has significant implications for the development of more accurate and efficient banking transaction classification systems, which can help reduce errors and improve customer experience.

Technical Contribution

The proposed framework integrates a novel combination of NLP and machine learning techniques, including attention-based neural networks and transfer learning, to achieve state-of-the-art performance in banking transaction classification.

Novelty

This work introduces a new approach to handling out-of-vocabulary words and unseen concepts in transaction classification systems, which has the potential to improve robustness and accuracy in real-world applications.

Limitations

- The dataset used was relatively small, which may limit the generalizability of the results to other domains or populations.

- The model's performance was evaluated on a controlled environment, which may not accurately reflect real-world scenarios.

Future Work

- Exploring the application of transfer learning and domain adaptation techniques to improve performance on diverse datasets.

- Investigating the use of multimodal fusion approaches to incorporate additional data sources, such as images or audio, into transaction classification systems.

- Developing more comprehensive evaluation metrics that capture nuanced aspects of transaction classification accuracy.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLarge Language Models Understanding: an Inherent Ambiguity Barrier

Daniel N. Nissani

Locating and Mitigating Gender Bias in Large Language Models

Enhong Chen, Yuchen Cai, Ding Cao et al.

Gender Bias in Machine Translation and The Era of Large Language Models

Eva Vanmassenhove

| Title | Authors | Year | Actions |

|---|

Comments (0)