Summary

Although quantile regression to calculate risk measures has been widely established in the financial literature, when considering data observed at mixed--frequency, an extension is needed. In this paper, a model is suggested built on a mixed--frequency quantile regression to directly estimate the Value--at--Risk (VaR) and the Expected Shortfall (ES) measures. In particular, the low--frequency component incorporates information coming from variables observed at, typically, monthly or lower frequencies, while the high--frequency component can include a variety of daily variables, like market indices or realized volatility measures. The conditions for the weak stationarity of the daily return process are derived and the finite sample properties are investigated in an extensive Monte Carlo exercise. The validity of the proposed model is then explored through a real data application using two energy commodities, namely, Crude Oil and Gasoline futures. Results show that our model outperforms other competing specifications, on the basis of some popular VaR and ES backtesting test procedures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

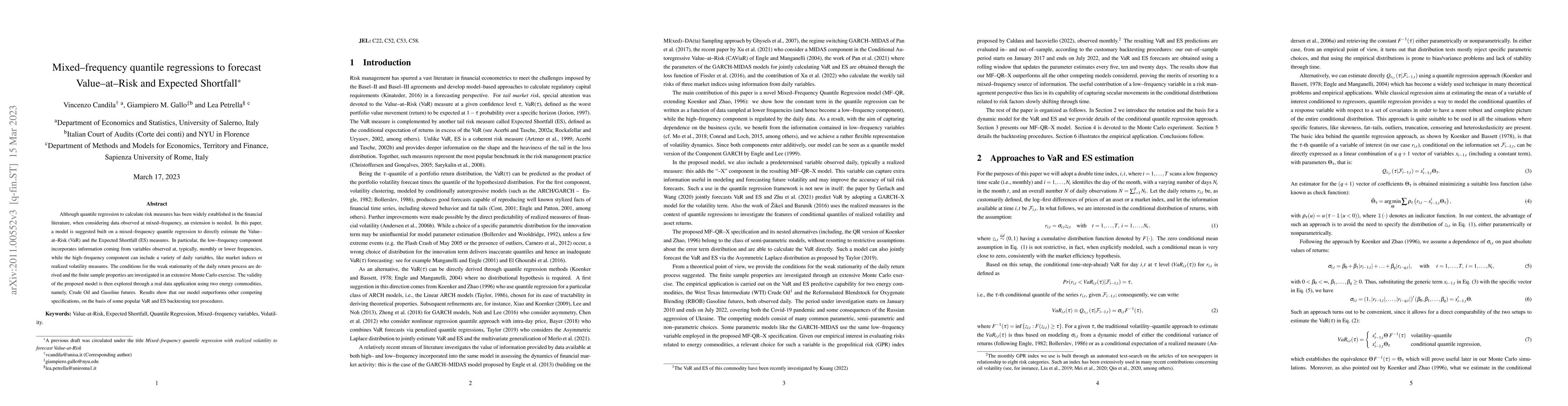

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSelf-Normalized Inference in (Quantile, Expected Shortfall) Regressions for Time Series

Christian Schulz, Yannick Hoga

| Title | Authors | Year | Actions |

|---|

Comments (0)