Authors

Summary

We introduce a model-free approach based on excursions of trading signals for analyzing the risk and return for a broad class of dynamic trading strategies, including pairs trading and other statistical arbitrage strategies. We propose a mathematical framework for the risk analysis of such strategies, based on a description in terms of excursions of prices away from a reference level, in a pathwise setting without any probabilistic assumptions. We introduce the notion of delta-excursion, defined as a path that deviates by delta from a reference level before returning to this level. We show that every continuous path has a unique decomposition into delta-excursions, which is useful for the scenario analysis of dynamic trading strategies, leading to simple expressions for the number of trades, realized profit, maximum loss, and drawdown. We show that the high-frequency limit, which corresponds to the case where delta decreases to zero, is described by the (p-th order) local time of the signal. In particular, our results yield a financial interpretation of the local time as the profit of a certain high-frequency mean-reversion trading strategy. Finally, we describe a non-parametric scenario simulation method for generating paths whose excursion properties match those observed in empirical data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

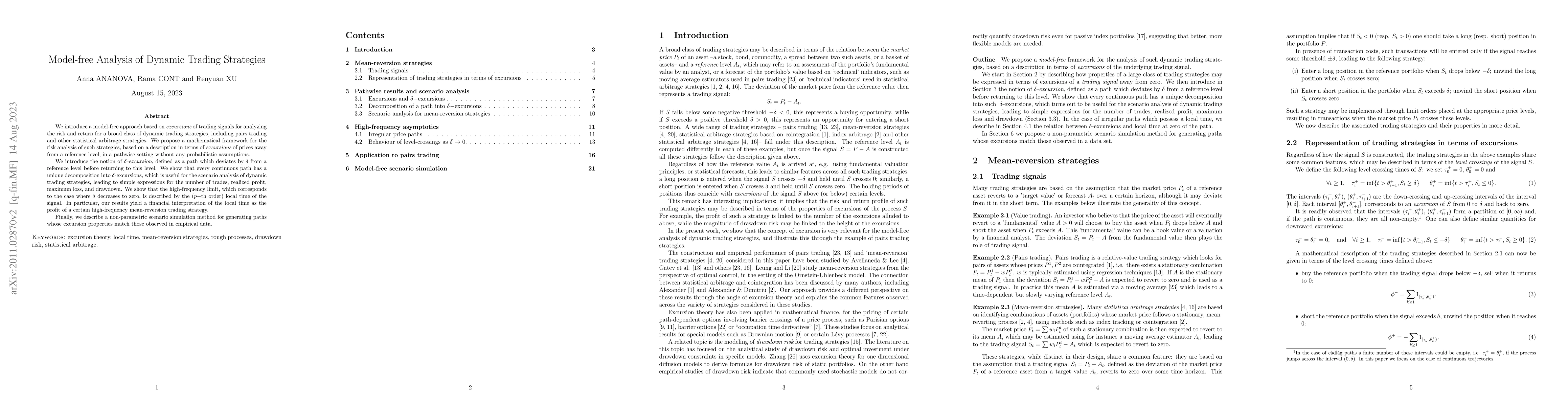

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)