Summary

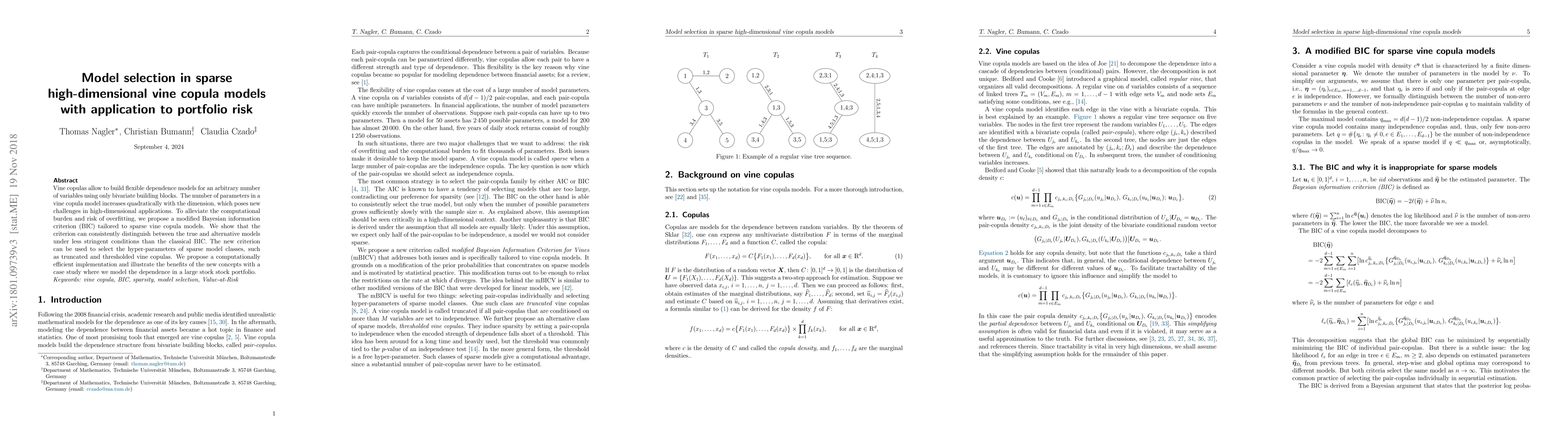

Vine copulas allow to build flexible dependence models for an arbitrary number of variables using only bivariate building blocks. The number of parameters in a vine copula model increases quadratically with the dimension, which poses new challenges in high-dimensional applications. To alleviate the computational burden and risk of overfitting, we propose a modified Bayesian information criterion (BIC) tailored to sparse vine copula models. We show that the criterion can consistently distinguish between the true and alternative models under less stringent conditions than the classical BIC. The new criterion can be used to select the hyper-parameters of sparse model classes, such as truncated and thresholded vine copulas. We propose a computationally efficient implementation and illustrate the benefits of the new concepts with a case study where we model the dependence in a large stock stock portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)