Summary

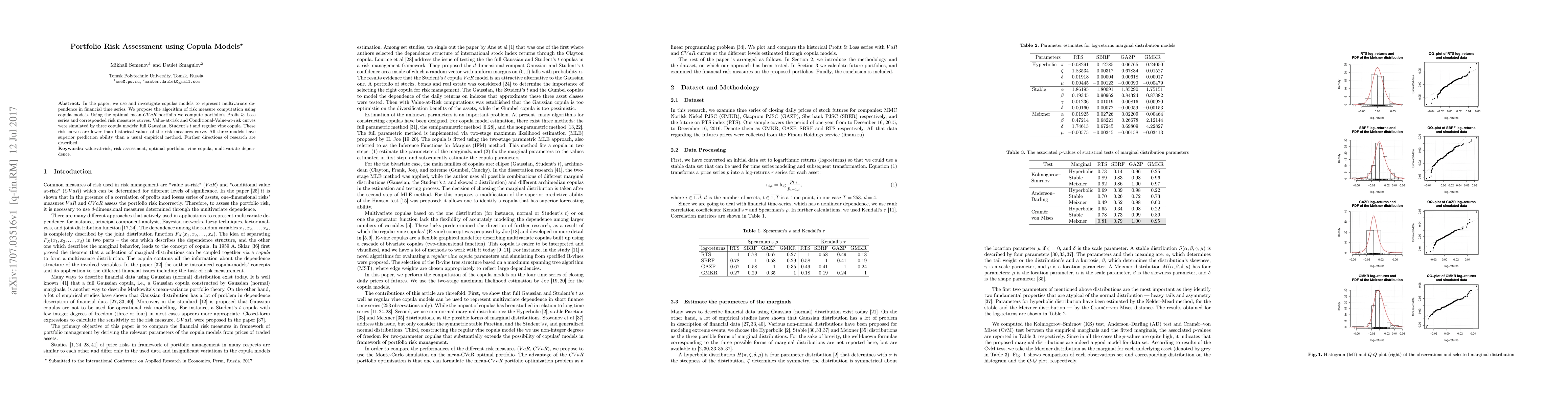

In the paper, we use and investigate copulas models to represent multivariate dependence in financial time series. We propose the algorithm of risk measure computation using copula models. Using the optimal mean-$CVaR$ portfolio we compute portfolio's Profit and Loss series and corresponded risk measures curves. Value-at-risk and Conditional-Value-at-risk curves were simulated by three copula models: full Gaussian, Student's $t$ and regular vine copula. These risk curves are lower than historical values of the risk measures curve. All three models have superior prediction ability than a usual empirical method. Further directions of research are described.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSemiparametric Dynamic Copula Models for Portfolio Optimization

Sujit K. Ghosh, Savita Pareek

Robust Bernoulli mixture models for credit portfolio risk

Jonathan Ansari, Eva Lütkebohmert

Vine Copula based portfolio level conditional risk measure forecasting

Emanuel Sommer, Claudia Czado, Karoline Bax

| Title | Authors | Year | Actions |

|---|

Comments (0)