Summary

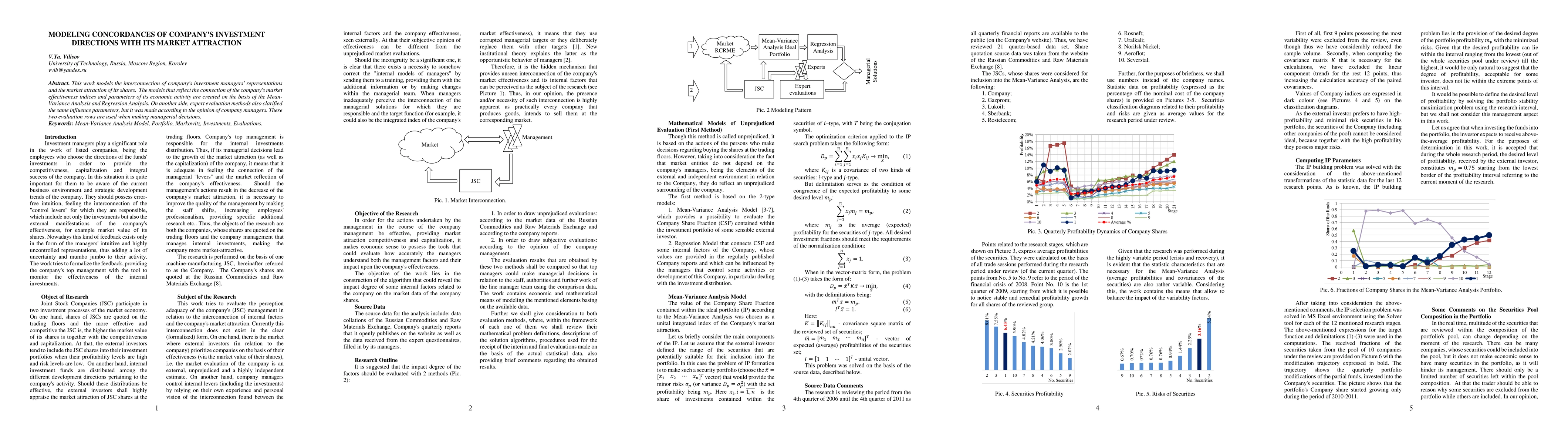

This work models the interconnection of company's investment managers' representations and the market attraction of its shares. The models that reflect the connection of the company's market effectiveness indices and parameters of its economic activity are created on the basis of the Mean-Variance Analysis and Regression Analysis. On another side, expert evaluation methods also clarified the same influence parameters, but it was made according to the opinion of company managers. These two evaluation rows are used when making managerial decisions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal consumption-investment with coupled constraints on consumption and investment strategies in a regime switching market with random coefficients

Ying Hu, Xiaomin Shi, Zuo Quan Xu

Lagrangian Approximation of Totally Real Concordances

Georgios Dimitroglou Rizell

No citations found for this paper.

Comments (0)