Authors

Summary

This paper studies finite-time optimal consumption-investment problems with power, logarithmic and exponential utilities, in a regime switching market with random coefficients, subject to coupled constraints on the consumption and investment strategies. We provide explicit optimal consumption-investment strategies and optimal values for the problems in terms of the solutions to some diagonally quadratic backward stochastic differential equation (BSDE) systems and linear BSDE systems with unbound coefficients. Some of these BSDEs are new in the literature and solving them is one of the main theoretical contributions of this paper. We accomplish the latter by applying the truncation, approximation technique to get some a priori uniformly lower and upper bounds for their solutions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

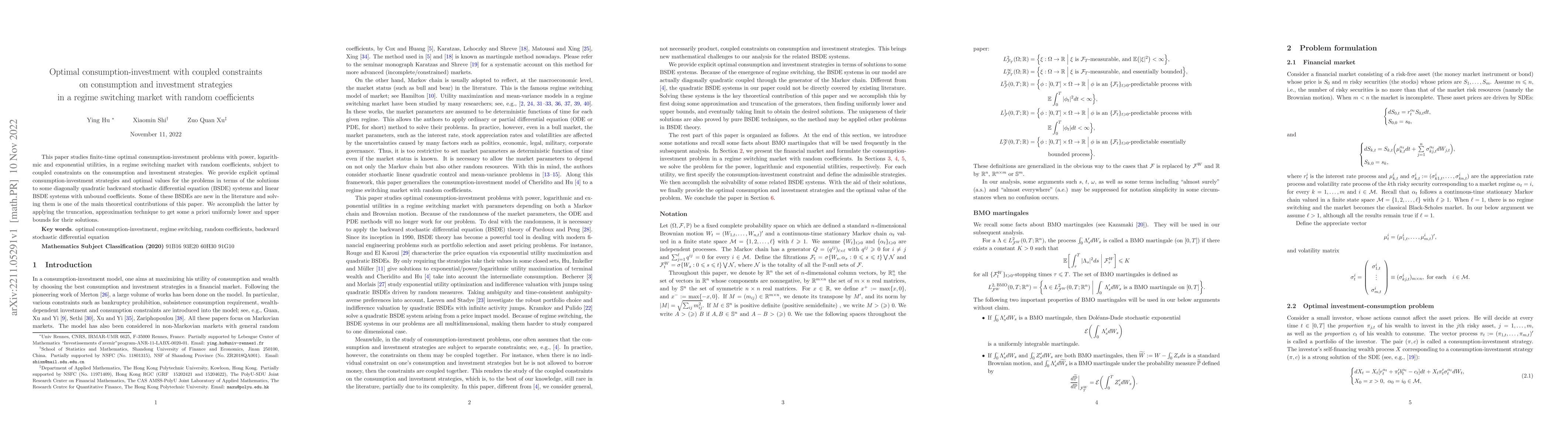

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust optimal investment and consumption strategies with portfolio constraints and stochastic environment

Len Patrick Dominic M. Garces, Yang Shen

| Title | Authors | Year | Actions |

|---|

Comments (0)