Summary

In a continuous time stochastic economy, this paper considers the problem of consumption and investment in a financial market in which the representative investor exhibits a change in the discount rate. The investment opportunities are a stock and a riskless account. The market coefficients and discount factor switches according to a finite state Markov chain. The change in the discount rate leads to time inconsistencies of the investor's decisions. The randomness in our model is driven by a Brownian motion and Markov chain. Following Ekeland etc (2008) we introduce and characterize the equilibrium policies for power utility functions. Moreover, they are computed in closed form for logarithmic utility function. We show that a higher discount rate leads to a higher equilibrium consumption rate. Numerical experiments show the effect of both time preference and risk aversion on the equilibrium policies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

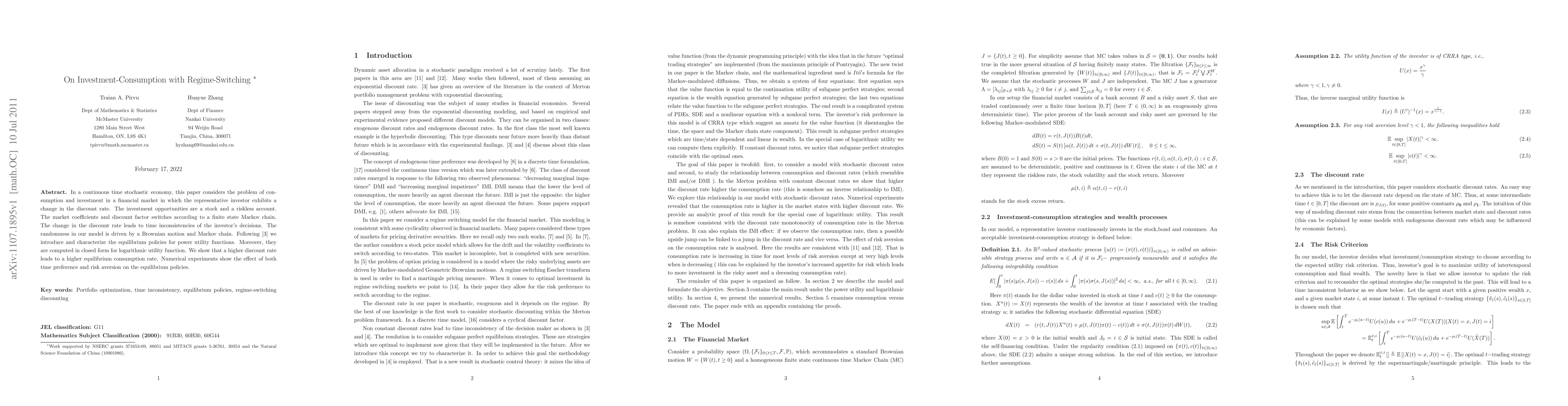

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)