Summary

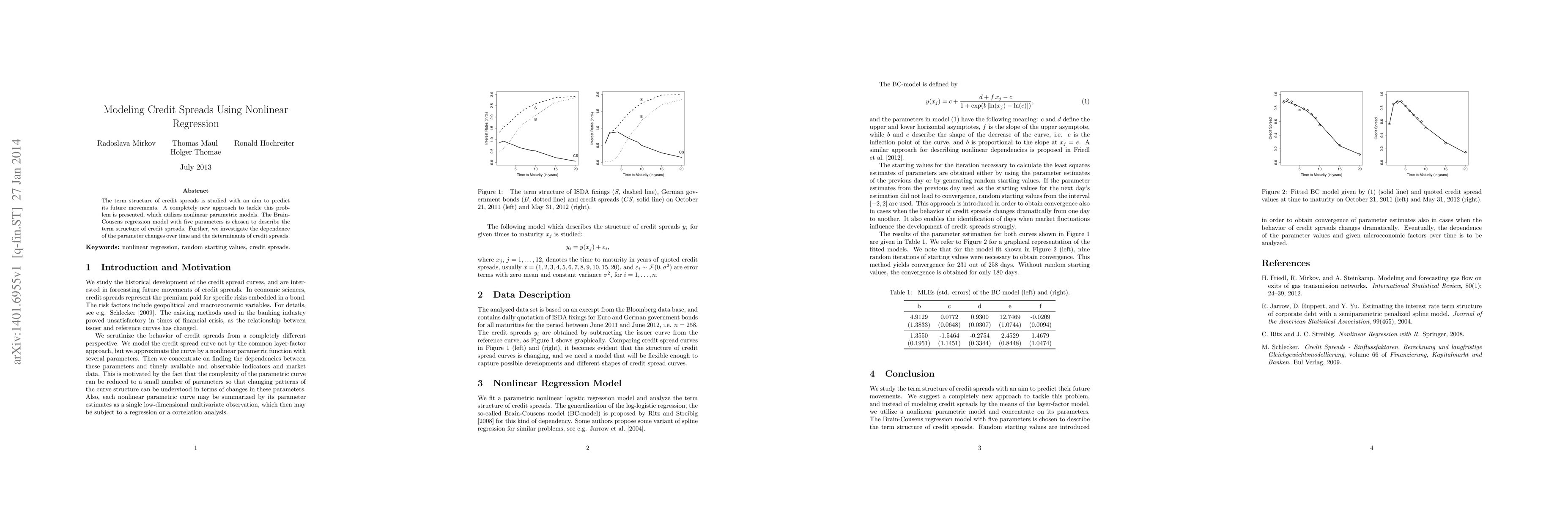

The term structure of credit spreads is studied with an aim to predict its future movements. A completely new approach to tackle this problem is presented, which utilizes nonlinear parametric models. The Brain-Cousens regression model with five parameters is chosen to describe the term structure of credit spreads. Further, we investigate the dependence of the parameter changes over time and the determinants of credit spreads.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Spreads' Term Structure: Stochastic Modeling with CIR++ Intensity

Ahmed Kebaier, Mohamed Ben Alaya, Djibril Sarr

Predicting Credit Spreads and Ratings with Machine Learning: The Role of Non-Financial Data

Chao Zhang, Xinlei Zhang, Yanran Wu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)