Summary

This paper introduces a novel stochastic model for credit spreads. The stochastic approach leverages the diffusion of default intensities via a CIR++ model and is formulated within a risk-neutral probability space. Our research primarily addresses two gaps in the literature. The first is the lack of credit spread models founded on a stochastic basis that enables continuous modeling, as many existing models rely on factorial assumptions. The second is the limited availability of models that directly yield a term structure of credit spreads. An intermediate result of our model is the provision of a term structure for the prices of defaultable bonds. We present the model alongside an innovative, practical, and conservative calibration approach that minimizes the error between historical and theoretical volatilities of default intensities. We demonstrate the robustness of both the model and its calibration process by comparing its behavior to historical credit spread values. Our findings indicate that the model not only produces realistic credit spread term structure curves but also exhibits consistent diffusion over time. Additionally, the model accurately fits the initial term structure of implied survival probabilities and provides an analytical expression for the credit spread of any given maturity at any future time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

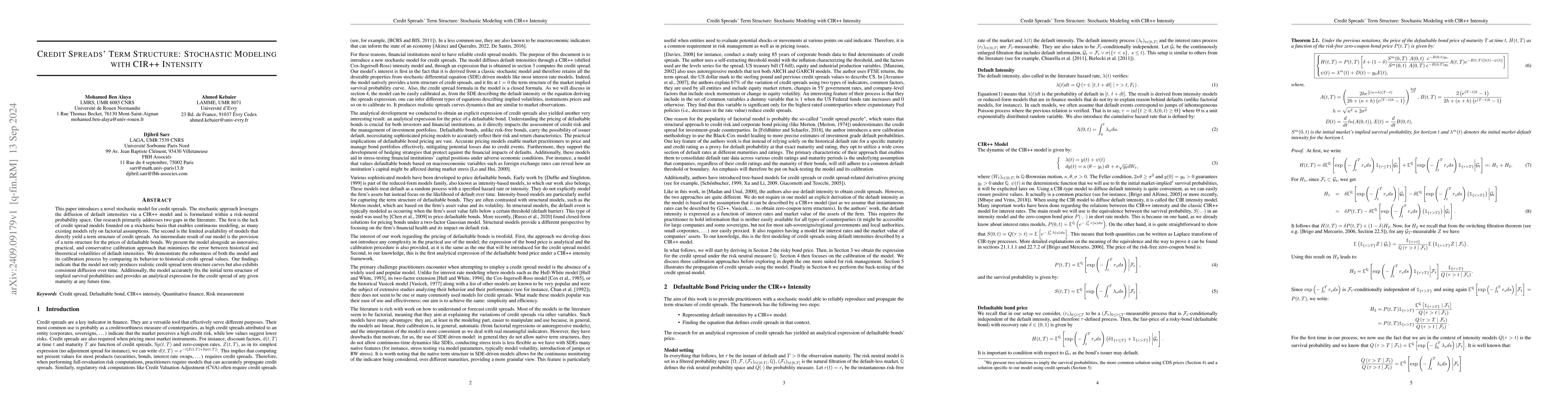

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersE-CIR: Event-Enhanced Continuous Intensity Recovery

Chen Song, Qixing Huang, Chandrajit Bajaj

| Title | Authors | Year | Actions |

|---|

Comments (0)