Summary

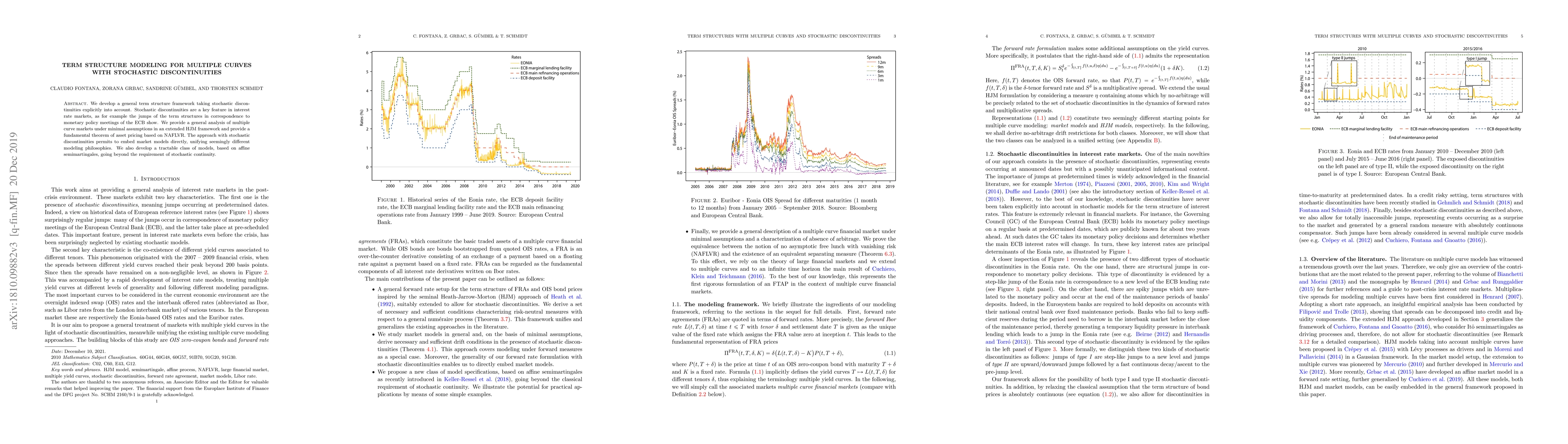

We develop a general term structure framework taking stochastic discontinuities explicitly into account. Stochastic discontinuities are a key feature in interest rate markets, as for example the jumps of the term structures in correspondence to monetary policy meetings of the ECB show. We provide a general analysis of multiple curve markets under minimal assumptions in an extended HJM framework and provide a fundamental theorem of asset pricing based on NAFLVR. The approach with stochastic discontinuities permits to embed market models directly, unifying seemingly different modeling philosophies. We also develop a tractable class of models, based on affine semimartingales, going beyond the requirement of stochastic continuity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Spreads' Term Structure: Stochastic Modeling with CIR++ Intensity

Ahmed Kebaier, Mohamed Ben Alaya, Djibril Sarr

Cylindrical stochastic integration and applications to financial term structure modeling

Philipp Harms, Johannes Assefa

Term structure modelling with overnight rates beyond stochastic continuity

Thorsten Schmidt, Claudio Fontana, Zorana Grbac

Bayesian Emulation for Computer Models with Multiple Partial Discontinuities

Jonathan Owen, Ian Vernon, Jonathan Carter

| Title | Authors | Year | Actions |

|---|

Comments (0)