Summary

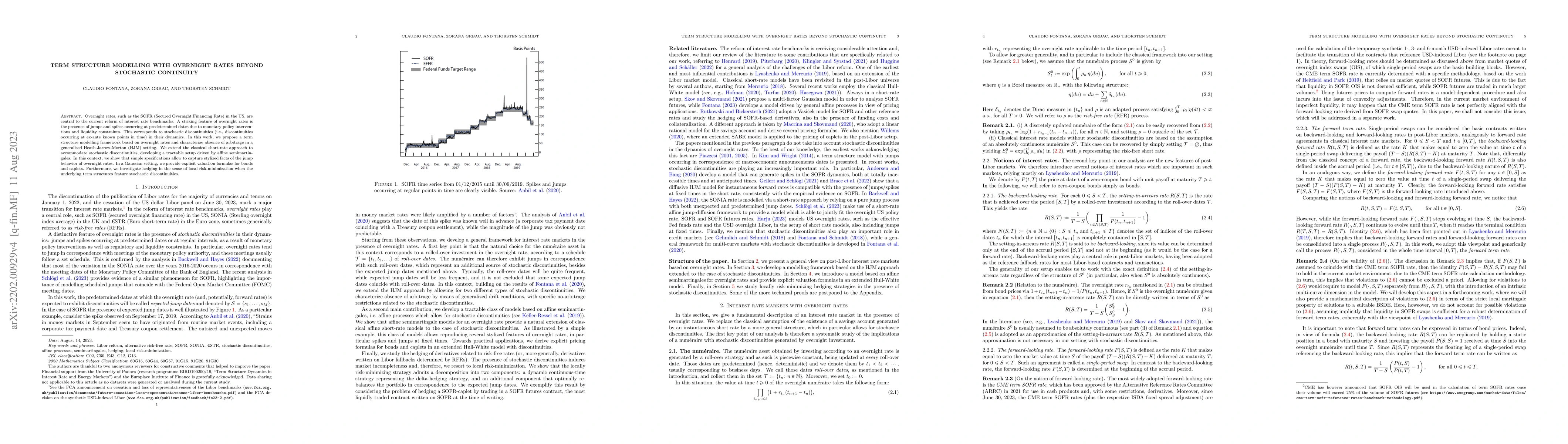

Overnight rates, such as the SOFR (Secured Overnight Financing Rate) in the US, are central to the current reform of interest rate benchmarks. A striking feature of overnight rates is the presence of jumps and spikes occurring at predetermined dates due to monetary policy interventions and liquidity constraints. This corresponds to stochastic discontinuities (i.e., discontinuities occurring at ex-ante known points in time) in their dynamics. In this work, we propose a term structure modelling framework based on overnight rates and characterize absence of arbitrage in a generalised Heath-Jarrow-Morton (HJM) setting. We extend the classical short-rate approach to accommodate stochastic discontinuities, developing a tractable setup driven by affine semimartingales. In this context, we show that simple specifications allow to capture stylized facts of the jump behavior of overnight rates. In a Gaussian setting, we provide explicit valuation formulas for bonds and caplets. Furthermore, we investigate hedging in the sense of local risk-minimization when the underlying term structures feature stochastic discontinuities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)