Summary

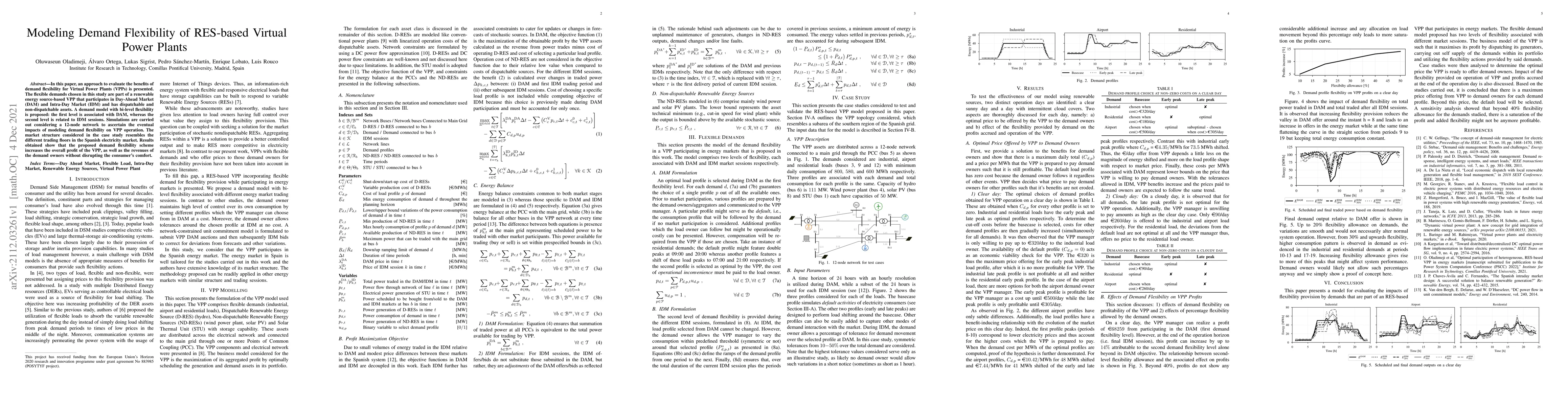

In this paper, an approach to evaluate the benefits of demand flexibility for Virtual Power Plants (VPPs) is presented. The flexible demands chosen in this study are part of a renewable energy source-based VPP that participates in Day-Ahead Market (DAM) and Intra-Day Market (IDM) and has dispatchable and non-dispatchable assets. A demand model with bi-level flexibility is proposed: the first level is associated with DAM, whereas the second level is related to IDM sessions. Simulations are carried out considering a 12-node network to ascertain the eventual impacts of modeling demand flexibility on VPP operation. The market structure considered in the case study resembles the different trading floors in the Spanish electricity market. Results obtained show that the proposed demand flexibility scheme increases the overall profit of the VPP, as well as the revenues of the demand owners without disrupting consumers' comfort.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)