Summary

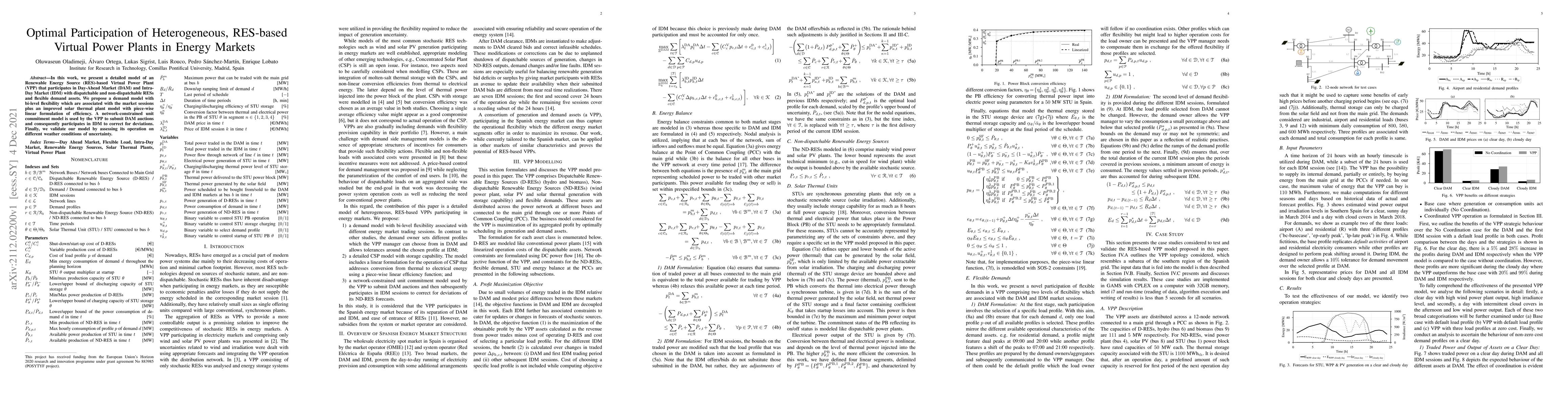

In this work, we present a detailed model of a Renewable Energy Source (RES)-based Virtual Power Plant (VPP) that participates in Day-Ahead Market (DAM) and Intra-Day Market (IDM) with dispatchable and non-dispatchable RESs and flexible demand assets. We propose a demand model with bi-level flexibility which are associated with the market sessions plus an improved solar thermal plant model with piece-wise linear formulation of efficiency. A network-constrained unit commitment model is used by the VPP to submit DAM auctions and consequently participates in IDM to correct for deviations. Finally, we validate our model by assessing its operation on different weather conditions of uncertainty.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDirect Participation of Dynamic Virtual Power Plants in Secondary Frequency Control

Bogdan Marinescu, M. Ebrahim Adabi

Flexible Robust Optimal Bidding of Renewable Virtual Power Plants in Sequential Markets

Enrique Lobato, Lukas Sigrist, Luis Rouco et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)