Summary

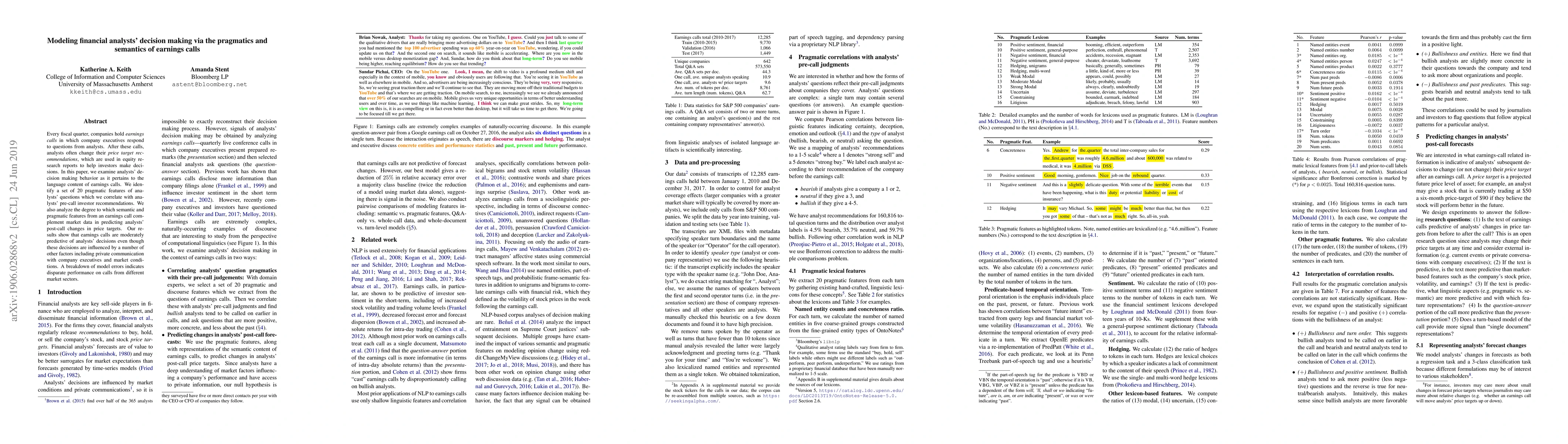

Every fiscal quarter, companies hold earnings calls in which company executives respond to questions from analysts. After these calls, analysts often change their price target recommendations, which are used in equity research reports to help investors make decisions. In this paper, we examine analysts' decision making behavior as it pertains to the language content of earnings calls. We identify a set of 20 pragmatic features of analysts' questions which we correlate with analysts' pre-call investor recommendations. We also analyze the degree to which semantic and pragmatic features from an earnings call complement market data in predicting analysts' post-call changes in price targets. Our results show that earnings calls are moderately predictive of analysts' decisions even though these decisions are influenced by a number of other factors including private communication with company executives and market conditions. A breakdown of model errors indicates disparate performance on calls from different market sectors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Exploratory Study of Stock Price Movements from Earnings Calls

Yang Yang, Sourav Medya, Brian Uzzi et al.

How do managers' non-responses during earnings calls affect analyst forecasts

Matias Carrasco Kind, Qingwen Liang

| Title | Authors | Year | Actions |

|---|

Comments (0)