Authors

Summary

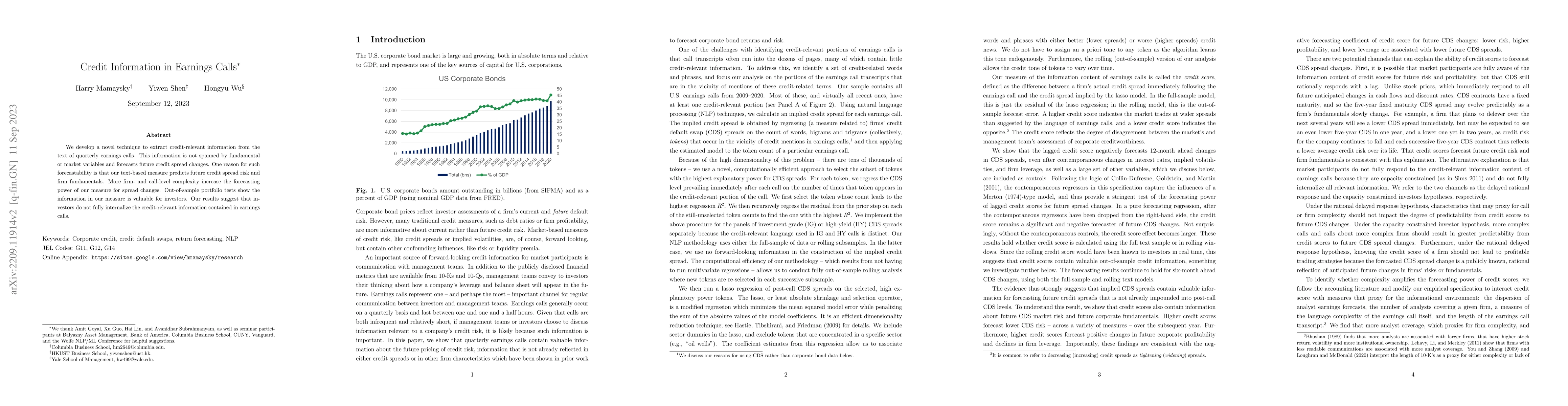

We develop a novel technique to extract credit-relevant information from the text of quarterly earnings calls. This information is not spanned by fundamental or market variables and forecasts future credit spread changes. One reason for such forecastability is that our text-based measure predicts future credit spread risk and firm profitability. More firm- and call-level complexity increase the forecasting power of our measure for spread changes. Out-of-sample portfolio tests show the information in our measure is valuable for investors. Both results suggest that investors do not fully internalize the credit-relevant information contained in earnings calls.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHow do managers' non-responses during earnings calls affect analyst forecasts

Matias Carrasco Kind, Qingwen Liang

An Exploratory Study of Stock Price Movements from Earnings Calls

Yang Yang, Sourav Medya, Brian Uzzi et al.

MiMIC: Multi-Modal Indian Earnings Calls Dataset to Predict Stock Prices

Sudip Kumar Naskar, Sohom Ghosh, Arnab Maji

Co-Trained Retriever-Generator Framework for Question Generation in Earnings Calls

Hen-Hsen Huang, Hsin-Hsi Chen, Chung-Chi Chen et al.

No citations found for this paper.

Comments (0)