Summary

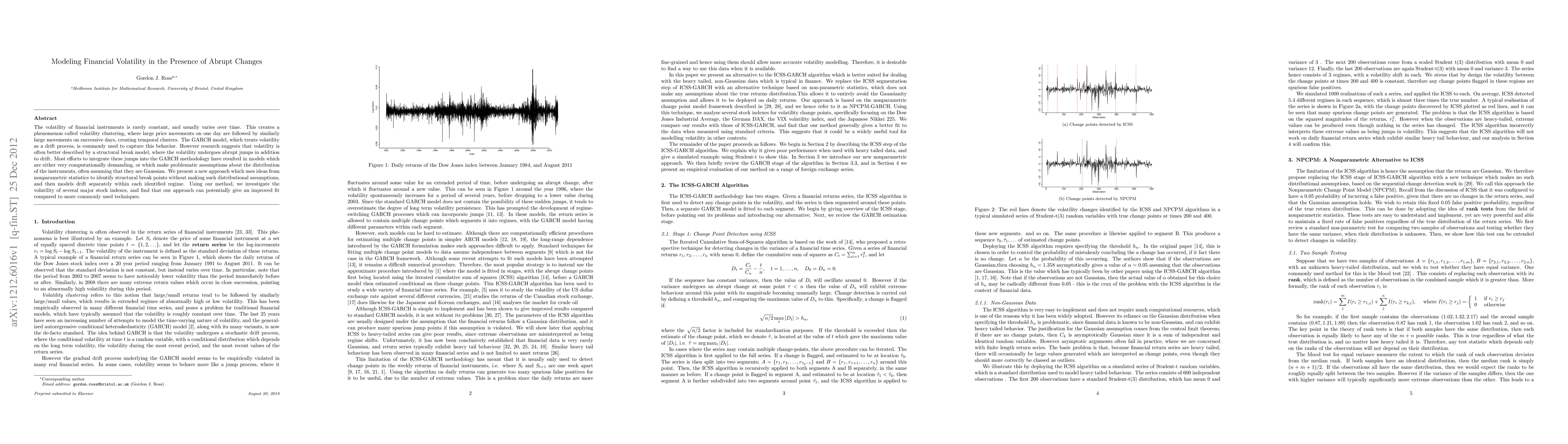

The volatility of financial instruments is rarely constant, and usually varies over time. This creates a phenomenon called volatility clustering, where large price movements on one day are followed by similarly large movements on successive days, creating temporal clusters. The GARCH model, which treats volatility as a drift process, is commonly used to capture this behavior. However research suggests that volatility is often better described by a structural break model, where the volatility undergoes abrupt jumps in addition to drift. Most efforts to integrate these jumps into the GARCH methodology have resulted in models which are either very computationally demanding, or which make problematic assumptions about the distribution of the instruments, often assuming that they are Gaussian. We present a new approach which uses ideas from nonparametric statistics to identify structural break points without making such distributional assumptions, and then models drift separately within each identified regime. Using our method, we investigate the volatility of several major stock indexes, and find that our approach can potentially give an improved fit compared to more commonly used techniques.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntegrated GARCH-GRU in Financial Volatility Forecasting

Zhenyu Cui, Steve Yang, Jingyi Wei

| Title | Authors | Year | Actions |

|---|

Comments (0)