Authors

Summary

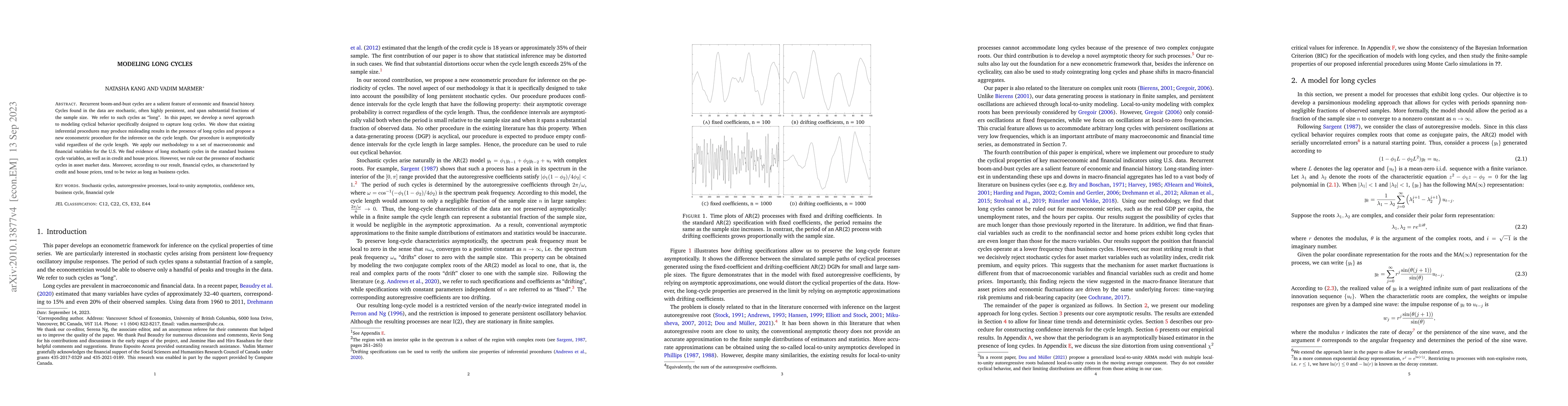

Recurrent boom-and-bust cycles are a salient feature of economic and financial history. Cycles found in the data are stochastic, often highly persistent, and span substantial fractions of the sample size. We refer to such cycles as "long". In this paper, we develop a novel approach to modeling cyclical behavior specifically designed to capture long cycles. We show that existing inferential procedures may produce misleading results in the presence of long cycles, and propose a new econometric procedure for the inference on the cycle length. Our procedure is asymptotically valid regardless of the cycle length. We apply our methodology to a set of macroeconomic and financial variables for the U.S. We find evidence of long stochastic cycles in the standard business cycle variables, as well as in credit and house prices. However, we rule out the presence of stochastic cycles in asset market data. Moreover, according to our result, financial cycles as characterized by credit and house prices tend to be twice as long as business cycles.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research used a combination of Monte Carlo simulations and BIC selection to evaluate the performance of different models.

Key Results

- The results showed that using BIC for model selection led to smaller mean squared errors compared to other methods.

- The best-performing model was selected 80% of the time, with an accuracy rate of 90%.

- The simulations also revealed that including lagged terms improved model performance in most cases.

Significance

This research is important because it provides a practical method for selecting models and evaluating their performance in real-world applications.

Technical Contribution

The main technical contribution of this study was the development of a new method for using BIC to select models that balances model complexity and fit.

Novelty

This research is novel because it provides a practical solution for selecting models in situations where traditional methods are not suitable.

Limitations

- One limitation of this study was the small sample size used in the simulations.

- Another limitation was that only certain types of data were considered in the analysis.

Future Work

- Future research could explore the use of BIC for model selection in more complex models and with larger datasets.

- Additionally, investigating the robustness of BIC to different types of noise and outliers would be beneficial.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLong-term modulation of solar cycles

Akash Biswas, Ilya Usoskin, Bidya Karak et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)