Summary

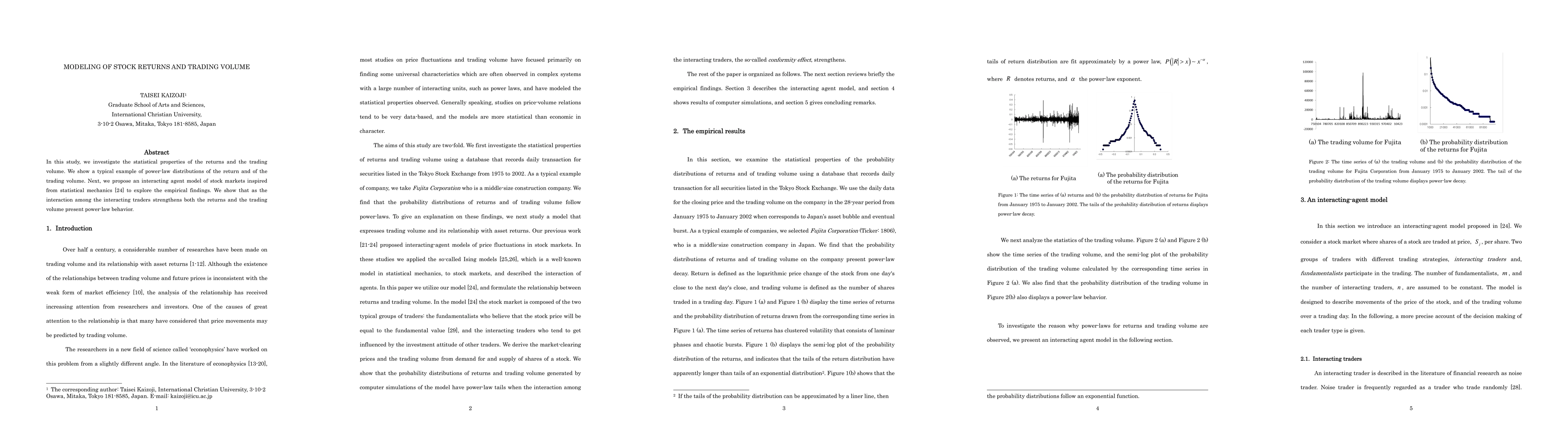

In this study, we investigate the statistical properties of the returns and the trading volume. We show a typical example of power-law distributions of the return and of the trading volume. Next, we propose an interacting agent model of stock markets inspired from statistical mechanics [24] to explore the empirical findings. We show that as the interaction among the interacting traders strengthens both the returns and the trading volume present power-law behavior.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)