Authors

Summary

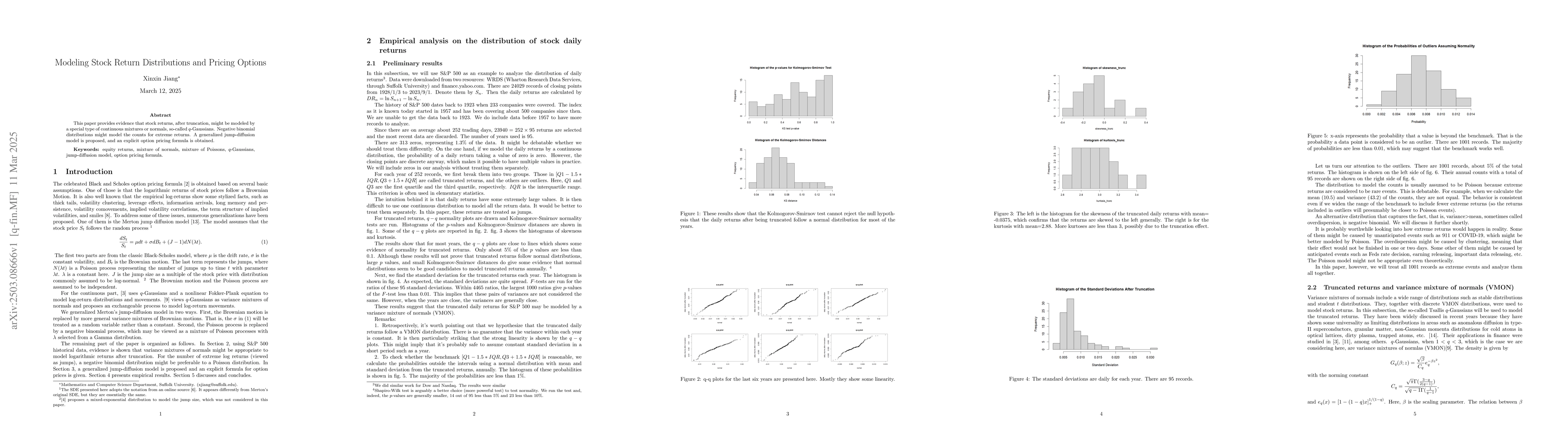

This paper provides evidence that stock returns, after truncation, might be modeled by a special type of continuous mixtures or normals, so-called $q$-Gaussians. Negative binomial distributions might model the counts for extreme returns. A generalized jump-diffusion model is proposed, and an explicit option pricing formula is obtained.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper proposes a generalized jump-diffusion model for stock pricing, utilizing q-Gaussians to model truncated stock return distributions and a negative binomial distribution for extreme return counts. The model is tested using S&P 500 data from 2007.

Key Results

- Stock return distributions can be modeled by variance mixtures of normals (q-Gaussians) after truncation.

- Negative binomial distributions might model the counts for extreme returns.

- An explicit option pricing formula is obtained from the generalized jump-diffusion model.

- Option prices from the GJD model show implied volatility smiles, differing from real market option prices.

- The GJD model overestimates option prices near the money for shorter maturities and underestimates for longer maturities and deep out-of-the-money options.

Significance

This research provides a novel approach to model stock returns and price options, incorporating both continuous and discrete elements, which could enhance financial modeling and risk management practices.

Technical Contribution

The paper introduces a generalized jump-diffusion model incorporating q-Gaussians for stock return distributions and a negative binomial distribution for extreme return counts, along with an explicit option pricing formula.

Novelty

This work stands out by combining q-Gaussians and a negative binomial distribution to model stock returns and option pricing, providing a more nuanced approach compared to traditional models that often rely solely on Gaussian distributions.

Limitations

- The study assumes constant interest rates and no dividends.

- Parameter estimation relies on specific statistical methods that may have their own limitations.

- The model's performance might vary with different market conditions not represented in the S&P 500 data used.

Future Work

- Investigate the model's applicability to other asset classes and markets.

- Explore the impact of varying interest rates and dividend policies on the model's predictions.

- Develop more robust methods for parameter estimation under different market scenarios.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)