Summary

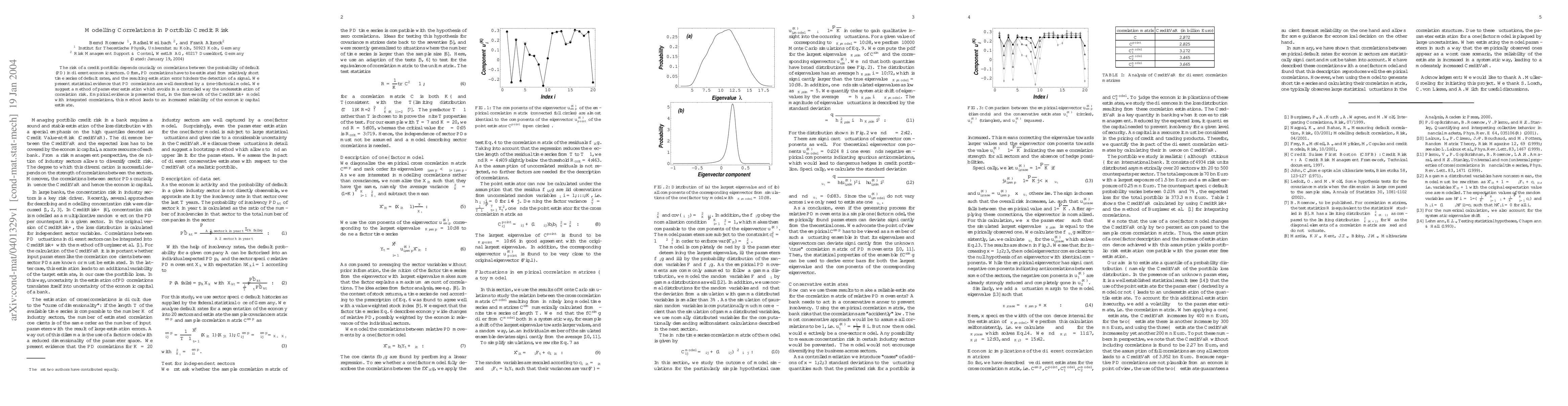

The risk of a credit portfolio depends crucially on correlations between the probability of default (PD) in different economic sectors. Often, PD correlations have to be estimated from relatively short time series of default rates, and the resulting estimation error hinders the detection of a signal. We present statistical evidence that PD correlations are well described by a (one-)factorial model. We suggest a method of parameter estimation which avoids in a controlled way the underestimation of correlation risk. Empirical evidence is presented that, in the framework of the CreditRisk+ model with integrated correlations, this method leads to an increased reliability of the economic capital estimate.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)