Summary

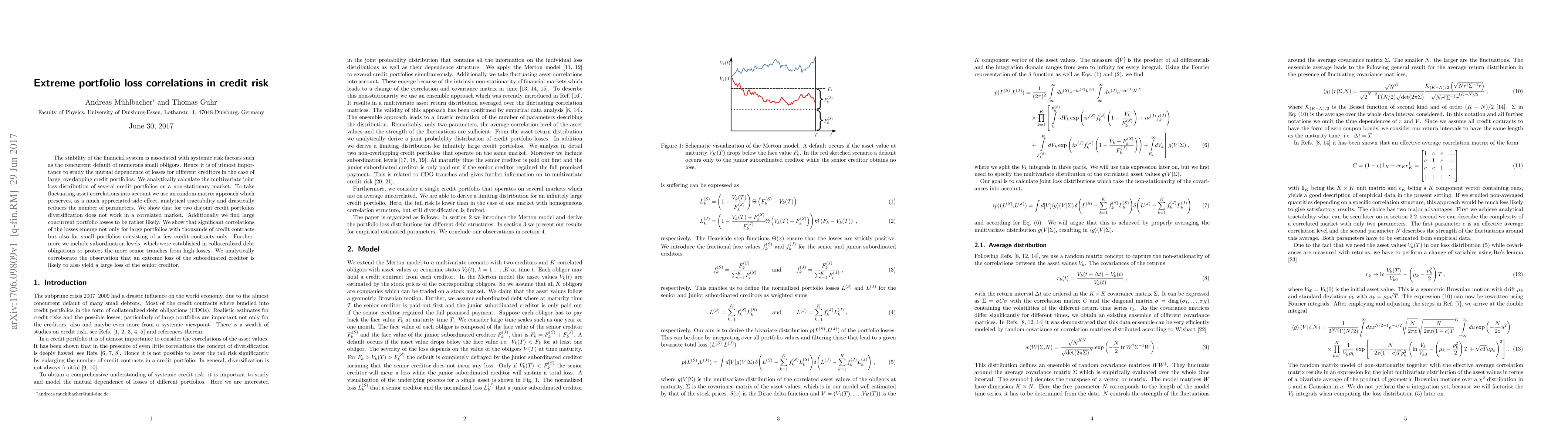

The stability of the financial system is associated with systemic risk factors such as the concurrent default of numerous small obligors. Hence it is of utmost importance to study the mutual dependence of losses for different creditors in the case of large, overlapping credit portfolios. We analytically calculate the multivariate joint loss distribution of several credit portfolios on a non-stationary market. To take fluctuating asset correlations into account we use an random matrix approach which preserves, as a much appreciated side effect, analytical tractability and drastically reduces the number of parameters. We show that for two disjoint credit portfolios diversification does not work in a correlated market. Additionally we find large concurrent portfolio losses to be rather likely. We show that significant correlations of the losses emerge not only for large portfolios with thousands of credit contracts but also for small portfolios consisting of a few credit contracts only. Furthermore we include subordination levels, which were established in collateralized debt obligations to protect the more senior tranches from high losses. We analytically corroborate the observation that an extreme loss of the subordinated creditor is likely to also yield a large loss of the senior creditor.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)