Summary

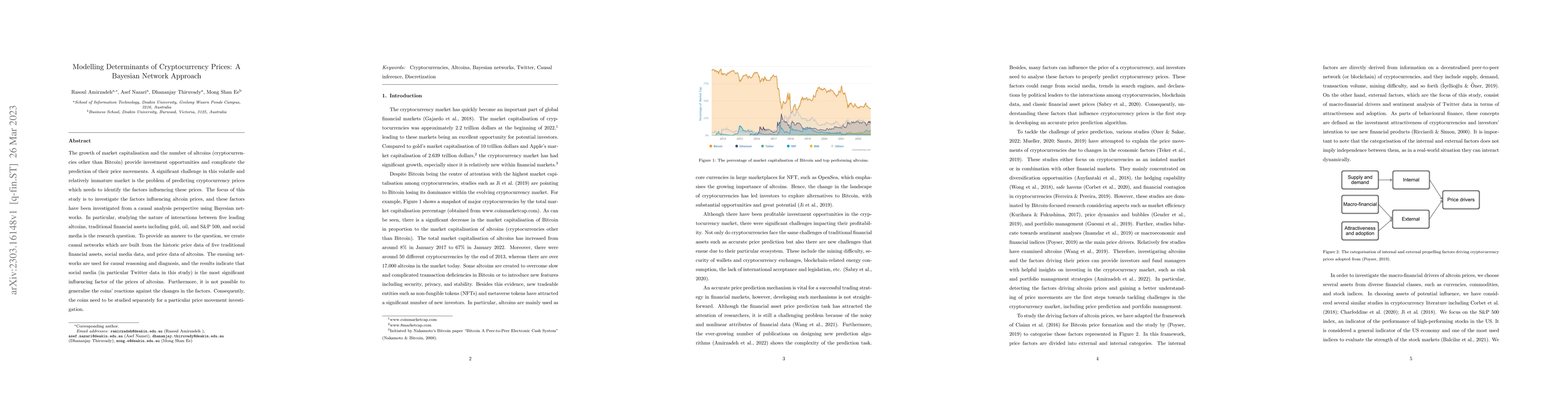

The growth of market capitalisation and the number of altcoins (cryptocurrencies other than Bitcoin) provide investment opportunities and complicate the prediction of their price movements. A significant challenge in this volatile and relatively immature market is the problem of predicting cryptocurrency prices which needs to identify the factors influencing these prices. The focus of this study is to investigate the factors influencing altcoin prices, and these factors have been investigated from a causal analysis perspective using Bayesian networks. In particular, studying the nature of interactions between five leading altcoins, traditional financial assets including gold, oil, and S\&P 500, and social media is the research question. To provide an answer to the question, we create causal networks which are built from the historic price data of five traditional financial assets, social media data, and price data of altcoins. The ensuing networks are used for causal reasoning and diagnosis, and the results indicate that social media (in particular Twitter data in this study) is the most significant influencing factor of the prices of altcoins. Furthermore, it is not possible to generalise the coins' reactions against the changes in the factors. Consequently, the coins need to be studied separately for a particular price movement investigation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCausality between Sentiment and Cryptocurrency Prices

Lubdhak Mondal, Udeshya Raj, Abinandhan S et al.

A Novel Hybrid Approach Using an Attention-Based Transformer + GRU Model for Predicting Cryptocurrency Prices

Esam Mahdi, C. Martin-Barreiro, X. Cabezas

Prediction of Cryptocurrency Prices through a Path Dependent Monte Carlo Simulation

Ayush Singh, Anshu K. Jha, Amit N. Kumar

Forecasting Cryptocurrency Prices using Contextual ES-adRNN with Exogenous Variables

Slawek Smyl, Grzegorz Dudek, Paweł Pełka

| Title | Authors | Year | Actions |

|---|

Comments (0)